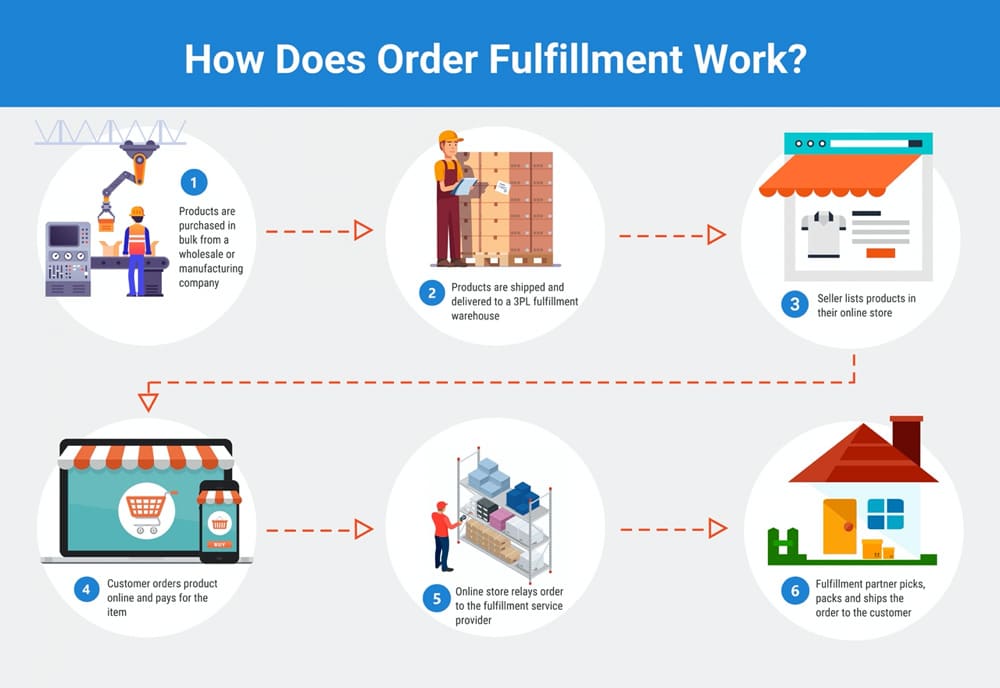

China-based fulfillment has evolved from a cost-saving tactic into an operations strategy—especially for Amazon FBA sellers who need compliant prep, reliable replenishment, and clear visibility from factory floor to FC check-in.

In 2025, the edge comes from two things: doing the Amazon basics flawlessly (labels, ASN/cartonization, Send to Amazon) and building trust through on-site verification before goods leave China.

This guide shows you exactly what to evaluate, who the major players are, and how to operationalize FBA compliance from a China warehouse with fewer chargebacks and surprises.

What a “China fulfillment center” actually does for Amazon FBA in 2025

At a minimum, a qualified China 3PL for Amazon sellers should be able to:

- Receive inventory from one or multiple factories, consolidate, and store by SKU/batch.

- Perform value-added services (VAs) like barcoding (FNSKU), kitting, bundling, reboxing, and carton labeling based on your FBA shipment plan.

- Prepare Amazon‑ready cartons and pallets that meet current label/pack requirements, then dispatch via the “Send to Amazon” workflow.

- Provide inventory visibility, photo evidence upon request, and exceptions handling (damage, shortages, relabeling) with quick SLAs.

- Support cross‑border shipping strategies (air/sea/express) and customs pathways to North America and Europe with transparent documentation.

Why this matters: even small mistakes—wrong label placement, barcode mismatch, incomplete box content info—can trigger receiving delays, chargebacks, or relabel fees. The fastest way to reduce those risks is to combine strict adherence to Amazon’s current rules with on‑site QC and photo verification before dispatch.

How to evaluate China fulfillment partners (checklist you can use)

1. Amazon FBA compliance depth

- Can they apply and verify Amazon barcodes (FNSKU vs manufacturer barcode), and ensure correct coverage of the manufacturer code when required?

- Do they understand “Send to Amazon,” box IDs for each carton, and pallet label rules?

2. On‑site QC with photo verification (hero differentiator)

- Do they offer sample photo sets before dispatch: close‑ups of FNSKU, carton labels on a flat panel, outer carton integrity, weight/dimensions on a calibrated scale, and a packing slip shot?

- Can a dedicated agent supervise on‑site checks and sign off on readiness?

3. SLA transparency and reliability

- Receiving‑to‑available time, same‑day pick/pack cutoff, dispatch windows, and peak‑season buffers.

- Returns/RMA processing time (e.g., 1–3 business days) and evidence flow.

4. Technology and visibility

- Inventory portal or WMS access, Amazon SP‑API/MWS awareness, ASN/box‑content data exchange.

5. Cross‑border lanes and customs handling

- Clarify DDP vs DDU options, VAT/IOSS workflows to the EU, and 2025 de minimis changes in the U.S. (see Regulatory Highlights below). Ask who the customs broker is and what data they require.

6. Pricing model clarity

- Storage by CBM/pallet, pick/pack tiers, label/kitting fees, return processing, palletization, photos/QC, and any peak‑season surcharges.

7. Geographic fit

- Proximity to your factory clusters (PRD—Guangdong; YRD—Zhejiang/Jiangsu/Shanghai; Fujian; etc.). Closer warehouses reduce drayage time and damage risk.

Amazon FBA rules you can’t ignore (and where they live)

- Product barcodes: Amazon requires a scannable barcode per FBA unit—either the manufacturer barcode or an Amazon barcode (FNSKU), depending on category/conditions. See Amazon’s official guidance in the 2025‑current help page for FBA product barcode requirements. When you use an Amazon barcode, ensure any manufacturer barcode is covered so only the correct code scans.

- Box and pallet labels: Each carton needs a unique FBA box ID label, and pallets must carry pallet labels on all four sides, placed on the outside of the stretch wrap. Amazon outlines these rules in its LTL/FTL and labeling hub; review the latest specifications in Amazon’s LTL/FTL and pallet guidance. Label placement matters—avoid seams and corners; use a flat panel.

- Send to Amazon workflow: Shipment planning, label generation, cartonization, and carrier selection all run through “Send to Amazon.” If you haven’t reviewed it recently, walk through the 2025‑current Seller Central instructions in Amazon’s Send to Amazon help page and align your 3PL’s SOPs to match.

2025 regulatory highlights that affect China-to-NA/EU fulfillment

- EU IOSS (≤ €150 B2C consignments): The Import One‑Stop Shop lets sellers collect VAT at checkout and file a single monthly return in one EU member state. Non‑EU sellers typically need an EU‑established intermediary. See the European Commission’s explanation in VAT e‑commerce (IOSS) overview.

- U.S. de minimis changes (Section 321): In 2025, U.S. Customs and Border Protection announced that, effective August 29, 2025, de minimis duty‑free entry is suspended; ACE will reject Section 321 manifest filings and Entry Type 86 submissions. Review CBP’s bulletin for exact language in CBP CSMS guidance (Aug 28, 2025). As policies evolve, align with your customs broker on current requirements and landed‑cost modeling.

- Transit conditions: Global ocean schedules have remained volatile across 2024–2025 due to ongoing disruptions. For context, trade data trackers have highlighted longer ocean transit times; you can see methodology and trend commentary in the Flexport Trade Activity Forecast Indicators. Treat all transit SLAs as ranges and build buffer into replenishment plans.

Top 10 China fulfillment centers (2025): who they are and when to consider them

Notes before you compare:

- The profiles below reflect verifiable, first‑party information and credible partner releases at the time of writing (Nov 2025). Where providers don’t explicitly state “Amazon FBA prep/labeling,” we don’t claim it. Instead, we characterize their documented e‑commerce warehousing/logistics strengths and where they may fit in your stack.

1. Cainiao (Alibaba Group)

- What’s verified: Global cross‑border network with growing North America footprint; June 2025 update added overseas warehouses across the U.S., Canada, and Mexico. See the official release in Cainiao’s NA warehouse expansion news (2025).

- Use when: You value a large network and lanes tied to Alibaba’s ecosystem and want options for NA/EU routing.

- Considerations: Public English pages don’t explicitly outline Amazon FBA prep/labeling SOPs; verify specifics during onboarding.

2. JD Logistics (JDL)

- What’s verified: International express coverage into North America and Europe, with a roadmap for a “2–3 Day Delivery” circle in 19 countries noted in late‑2024/2025 updates; see JD Logistics news center: 2–3 Day service circle. JD corporate communications also describe expanded express services to NA/EU; see JD corporate blog overview.

- Use when: You need vertically integrated options from a major Chinese logistics brand.

- Considerations: Confirm warehouse VAs (labeling, kitting) and FBA‑specific prep during discovery; public SLA tables are limited.

3. SF Supply Chain / SF International (SF Holding)

- What’s verified: Integrated warehousing and cross‑border e‑commerce logistics documented in investor materials; see SF Holding 2024 Annual Report (English) and related updates.

- Use when: You want a leading China logistics provider with established international operations.

- Considerations: FBA‑specific prep isn’t detailed on the English investor pages; validate via solution teams and SOP walkthroughs.

4. 4PX

- What’s verified: Global cross‑border e‑commerce logistics and overseas warehousing under its fulfillment network; see the official site at 4PX global overview.

- Use when: You need broad cross‑border parcel solutions paired with warehousing options.

- Considerations: Confirm the extent of warehouse value‑added services and any Amazon‑specific compliance steps during scoping.

5. YunExpress (Zongteng Group)

- What’s verified: Cross‑border parcel specialist with growing air capacity; in March 2024, YunExpress and Atlas Air added a second 777‑200 freighter operating six weekly China–U.S. routes; see Atlas Air x YunExpress partnership. Company overview: YunExpress about page.

- Use when: You prioritize premium parcel capacity to the U.S. and Europe alongside China fulfillment nodes.

- Considerations: Warehouse VAs and FBA‑specific prep are not detailed on the English pages; verify scope and SOPs.

6. ZTO Express (International)

- What’s verified: Integrated logistics with warehousing and international expansion indicated in corporate reporting; see the 2025 filing notes in ZTO 2025 annual report reference.

- Use when: You prefer a leading courier group with evolving cross‑border and warehousing capabilities.

- Considerations: FBA‑specific prep/labeling not publicly specified; request documented SOPs and example SLAs.

7. Kerry Logistics Network (KLN)

- What’s verified: Global logistics provider citing overseas warehouse network and growth; see Kerry Logistics 2025 press release.

- Use when: You need multi‑modal, multi‑region solutions with an enterprise‑grade logistics partner.

- Considerations: Confirm e‑commerce fulfillment specifics (labeling, returns) and Amazon compliance procedures during discovery.

8. DHL Group (eCommerce/Supply Chain China)

- What’s verified: Established e‑commerce logistics presence noted in global reports; see DHL Group 2024 Annual Report.

- Use when: You need a global partner with standardized processes and broad lane options.

- Considerations: FBA‑specific prep is not detailed in the cited report; validate available VAs in China warehouses.

9. BEST Inc. (cross‑border/e‑commerce solutions)

- What’s verified: Public materials frequently reference e‑commerce logistics and international capabilities; ensure discovery against their current 2025 service pages.

- Use when: You’re exploring diversified Chinese logistics providers.

- Considerations: Due to variability in public English documentation, insist on current SOPs and pricing schedules before onboarding.

10. J&T Express (International)

- What’s verified: Rapid growth across Asia and expanding international lanes; English 2025 pages vary by region.

- Use when: Testing parcel lanes and regional coverage that may complement your CN warehouse.

- Considerations: Verify China warehouse VAs, returns, and Amazon‑specific compliance before committing.

How to use this list: Treat it as a shortlist for discovery calls. For each candidate, ask for written SOPs that map to Amazon’s barcode and labeling requirements, a sample photo‑verification set, and SLA/fee schedules. If they can’t produce these quickly, keep looking.

A practical, end‑to‑end Amazon FBA workflow from a China warehouse

Here is a concrete SOP you can use or adapt with any serious fulfillment partner in 2025.

1. Pre‑receiving and data handoff

- Share SKU master, cartonization plan, and advance shipment notice (ASN) details.

- Provide the “Send to Amazon” shipment plan outputs (box IDs, pallet plans if applicable) or authorize the 3PL to create and share back for approval.

2. Goods receiving and put‑away

- Warehouse logs carton counts, inspects outer cartons, records weights/dimensions, and assigns storage locations. Exceptions are flagged immediately.

3. On‑site QC with photo verification (non‑negotiable in 2025)

- Define a shot list: (a) FNSKU close‑up on sample units; (b) any covered manufacturer barcodes; (c) each carton’s FBA box label on a flat surface; (d) outer carton integrity; (e) weight/dimensions; (f) pallet labels on four sides if palletized.

- Require timestamped photos stored against the ASN in WMS or shared cloud folder.

4. Labeling and carton prep

- Apply FNSKU (if used) and fully cover other scannable barcodes to prevent mis‑scans. Align with Amazon’s rules in the 2025‑current help on FBA product barcode requirements.

- Print and apply carton IDs from “Send to Amazon” on a flat panel—avoid seams/edges. Follow pallet labeling in Amazon’s LTL/FTL and pallet guidance.

5. Booking and dispatch

- Confirm same‑day cutoffs and carrier pickup windows. If palletized, ensure appointment processes are followed.

- Retain all documentation (packing list, label PDFs, photo evidence) to support receiving.

6. Post‑dispatch monitoring

- Track shipment status to FC and reconcile receiving against the box content information. Use your photo evidence set to dispute shortages or mis‑scans.

Neutral example (first mention): A dedicated agent model can remove friction here. For instance, a 1‑on‑1 agent from Yansourcing coordinates the on‑site photo verification (FNSKU close‑ups, carton labels, and pallet labels) before releasing the shipment, then monitors the reconciliation when Amazon checks in.

RFP and onboarding checklists (copy/paste for your next call)

Ask these questions and request these artifacts from every China fulfillment center you evaluate:

FBA compliance artifacts

- Written SOP that references the latest “Send to Amazon” steps and barcode/label rules (with screenshots or help links).

- Sample photo‑verification set from a recent job (redacted), covering FNSKU, carton labels, pallet labels, weight/dimensions.

SLAs and calendars

- Receiving‑to‑available; same‑day cutoff; dispatch windows; returns processing time. Include a 2025 peak‑season/holiday calendar and blackout dates (Golden Week, Singles’ Day, Lunar New Year).

Pricing schedule

- Storage (CBM/pallet), pick/pack tiers, labeling per unit/carton, kitting/bundling, palletization, returns handling, photo/QC fees, and any surcharge tables.

Tech & visibility

- Portal/WMS demo, inventory and ASN fields, exportable reports, webhook/API options for alerts.

Customs & regulatory readiness

- EU IOSS workflow (≤ €150) and intermediary support. U.S. 2025 de minimis changes and their current brokerage approach. Documentation templates (commercial invoice, packing list, HS codes, valuation method).

Exceptions handling

- Damage photos, relabel steps, timelines for contacting the factory, and how they help dispute FC receiving discrepancies using your photo set.

What good performance looks like (practical benchmarks)

These are not promises—treat them as starting points for negotiation and verification:

- Receiving to available: same day to 48 hours for standard SKUs, longer for kitting/rework.

- Same‑day dispatch cutoff: late morning to early afternoon; confirm local time.

- Returns processing: within 1–3 business days for inspection and restock/hold.

- Photo verification: provided within 24 hours of request or embedded in the SOP for every outbound FBA.

- Transit planning: build buffers; ocean vs air vs express choices shift with market conditions highlighted by trackers like the Flexport Trade Activity Forecast Indicators.

Cost components to model (without surprises)

- Storage: CBM or pallet monthly rates; minimums; long‑term storage thresholds.

- Handling: Receiving fees by carton/pallet, per‑SKU induction charges.

- Pick/pack: Tiered by order line count; cartonization/overbox fees for FBA shipments.

- Labels & kitting: Per‑unit FNSKU, per‑carton FBA label, bundle assembly, polybagging/insert fees.

- Palletization: Pallet and wrap materials, labor, label application.

- Photos/QC: Per‑set or per‑hour. Aim to make pre‑dispatch photo verification a default for FBA.

- Returns: Processing, relabeling, refurbishment, reboxing.

- Cross‑border: Freight (air/sea/express), brokerage, duties/VAT (IOSS when eligible), insurance, and surcharges/peak fees.

Tip: Ask each provider to complete your standardized fee template so you can compare like‑for‑like. Require a surcharge calendar so Q4 and promotional periods don’t blow up your margins.

2025 risk radar and how to mitigate it

- Regulatory flux (U.S. de minimis): After August 29, 2025, expect duty assessment pathways to change; align with brokers, and shift pricing to landed‑cost quotes. See CBP’s notice in CBP CSMS guidance (Aug 28, 2025).

- Labeling and barcode errors: Anchor SOPs to Amazon’s live help pages for barcodes and LTL/FTL & pallet guidance. Make photo evidence non‑negotiable.

- Peak seasons: Secure capacity early and negotiate blackout exceptions. Add safety stock ahead of Singles’ Day and Lunar New Year.

- Supplier variability: Use incoming QC sampling (AQL) and pre‑dispatch checks to catch label/packaging defects that originate at the factory.

- Visibility gaps: If the 3PL’s portal is weak, mandate standardized weekly reports (inventory, exceptions, outbound confirmations with photo links).

Putting it all together

If you’re an Amazon FBA seller in 2025, your China fulfillment center is more than storage. It’s a compliance partner that prevents chargebacks, accelerates replenishment, and documents reality before cartons leave China. Vet on the details (labels, photos, SLAs), not logos.

Next steps

- Shortlist 3–5 providers from the Top 10 based on your lanes and SKU complexity.

- Send a standardized RFP with the checklists above.

- Run a 30-day pilot focusing on one replenishment cycle with full photo verification and SLA tracking.

Want help mapping your SKUs, lanes, and FBA compliance plan? Book a 15-minute consultation with a dedicated agent here: Yansourcing.