If you source electronics or mobile accessories, Global Sources (GS) is one of the few platforms that pairs online supplier discovery with large Hong Kong trade shows. In 2025, that online-to-offline combo is its core value proposition.

What follows is a numbers-aware, practitioner’s review focused on safety, verification badges, the buyer workflow, and where GS fits vs. Alibaba and Made‑in‑China.

Quick answers (for busy buyers)

- Who this review helps most: experienced e‑commerce sellers and SME sourcing managers looking for dependable ODM/OEM partners in electronics/mobile. First‑time importers can still benefit, but GS shines when you already know what to ask and how to evaluate.

- Single takeaway about GS: a higher‑signal route to vetted electronics suppliers plus the Hong Kong shows that let you finish due diligence face‑to‑face.

- One concrete moment of save/fail: We don’t publish unverifiable anecdotes. Instead, this review gives a step‑by‑step workflow you can replicate, with risk‑mitigation checkpoints at each stage.

- Tangible differences vs. Alibaba/Made‑in‑China: generally tighter supplier curation for electronics, less search noise, and more export‑ready factories; Alibaba offers breadth and Trade Assurance; Made‑in‑China is factory‑forward but often higher MOQs. Details below with evidence.

- Hong Kong shows vs. on‑site badges: If you can’t attend, rely on GS’s Verified Supplier/Manufacturer badges and then confirm with your own audits and lab tests. If you can attend, the April/October shows at AsiaWorld‑Expo compress vetting into days.

What Global Sources is in 2025—and who it’s for

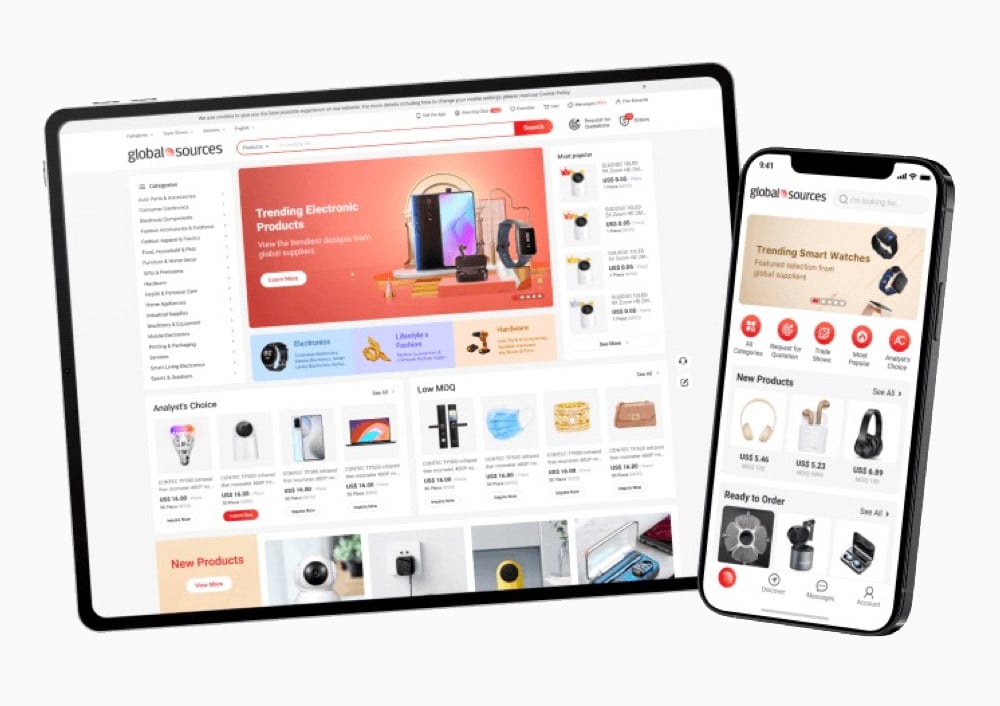

- GS operates a B2B marketplace plus Hong Kong trade shows, with a strong emphasis on consumer/mobile electronics and related categories, per the platform’s corporate overview in 2025. See the Global Sources corporate about page for its O2O model explanation: Global Sources Corporate About (2025).

- Best‑fit buyers: electronics category leads, Amazon/private‑label brands, and sourcing managers who value verified business credentials and in‑person validation.

Trust and safety: what the badges do—and don’t—cover

- Verified Supplier and Verified Manufacturer: According to Global Sources’ Knowledge Center (2024–2025), “Verified Suppliers” have their business credentials authenticated by third parties such as D&B, Experian, TÜV SÜD, Ease Credit, or Addcredit; “Verified Manufacturers” are verified suppliers whose officially sanctioned scope includes manufacturing. See the definitions in the GS Knowledge Center: Verified supplier/manufacturer criteria (GS Knowledge, 2024–2025).

- Scope limits: The badges focus on company legitimacy and manufacturing authorization; they do not certify that a specific product meets CE/RoHS/FCC. Buyers should request certificates and validate with issuing bodies or accredited labs. GS explains legitimacy checks and safe‑sourcing steps in its guidance: Confirm supplier legitimacy (GS Knowledge, 2024–2025).

- Payment protection: We found no evidence that GS holds buyer funds in escrow or offers Alibaba‑style Trade Assurance in 2025. GS focuses on education around secure payments and anti‑fraud practices: Safe sourcing and payments (GS Knowledge, 2024–2025).

Step‑by‑step buyer workflow (with tips, red flags, and checklists)

1. Market scan and shortlist

- Use filters (category, region, new products) and prioritize Verified Supplier/Verified Manufacturer. Review years in business, export markets, and uploaded certs; request copies early.

- Red flags: mismatched license names vs. bank details; evasive answers about tooling ownership; too‑good‑to‑be‑true quotes.

- Useful references: GS’s safe‑sourcing overview gives a sanity‑check list for legitimacy and payments: GS safe sourcing overview (2024–2025).

2. Outreach: inquiry vs. RFQ

- Aim for 5–10 suppliers initially. Your RFQ should include tight specs (materials, tolerances), compliance targets (CE/FCC/RoHS/REACH as applicable), projected volume and desired MOQ flexibility, target Incoterms, and sample/testing expectations.

- Red flags: unwillingness to quote under FOB/EXW clarity; unclear warranty; refusal to discuss corrective action on defects.

- GS help materials explain how inquiries work on-platform: How to send inquiries (GS Help, 2024–2025).

3. Samples and evaluation

- Set a pass/fail rubric: fit/form/function, safety, packaging, labeling, and documentation. Keep a log of sample lead time and cost by supplier.

- Require lab tests where compliance is mandatory; verify certificates with the issuer.

- Process discipline: GS highlights QRQC concepts that help you react quickly to issues: QRQC overview (GS Knowledge, 2024–2025).

4. Negotiation: MOQ, pricing, and terms

- Seek tiered MOQs and clear price breaks, confirm lead times with penalties where feasible, and stage payments (e.g., 30/70 T/T) to align with inspections.

- Incoterms matter for risk allocation; GS provides explainers on DDP and FOB implications: DDP explained (GS Knowledge, 2024–2025) and FOB explained (GS Knowledge, 2024–2025).

5. Pre‑shipment QC and compliance

- Book third‑party inspections with an AQL plan; validate any CE/FCC/RoHS claims directly with cert bodies or labs. Document major/minor defects and enforce rework.

- Keep a deviation log to track supplier adherence to timelines and specs; apply CAPA where needed.

6. Logistics and post‑shipment

- Monitor transit and inspect inbound cartons at destination. Feed issues back into your CAPA loop and adjust terms/tooling as needed.

Hong Kong shows: compress your due diligence into days

- Venue and 2025 schedule: GS’s electronics and lifestyle shows run at AsiaWorld‑Expo (AWE), typically in April and October. For 2025, venue and dates are listed by AWE/MEHK: Electronics Oct 11–14, 2025 (AWE), Lifestyle Oct 18–21, 2025 (AWE), and spring editions in April per MEHK listings: Consumer Electronics Apr 11–14, 2025 (MEHK), Lifestyle Apr 18–21, 2025 (MEHK).

- How to prep: Build a target‑booth list from your online shortlist. Carry a one‑pager spec sheet, ask to see certs, BOM highlights, and process controls. Photograph labels/markings for compliance checks.

- Booth audit checklist: certifications (with issuer/lab), tooling ownership and change‑control, in‑house vs outsourced processes, sample lead time and cost, typical MOQ, and post‑launch support.

- Post‑show cadence: send a recap email within 48 hours; request golden samples; schedule a video audit or on‑site audit within two weeks.

Global Sources vs. Alibaba vs. Made‑in‑China: when to choose which

- Electronics specialization and curation: Practitioner comparisons in 2024–2025 cite GS’s stronger electronics focus and curated supplier pool; Alibaba offers unmatched breadth and Trade Assurance; Made‑in‑China is more factory‑centric but may have higher MOQs. See the practitioner analyses: CosmoSourcing comparison (2024) and EJET comparison (2024).

- Practical takeaway: If you need electronics ODM/OEM partners and can leverage the HK shows, GS gives a higher‑signal shortlist. If you prioritize platform escrow and maximum catalog breadth, Alibaba is stronger. If you’re targeting industrial/factory‑heavy categories and can handle higher MOQs, add Made‑in‑China to your scan.

Pricing and membership clarity (buyers vs. suppliers)

- Buyers: Creating an account to search and inquire appears to be free as of 2025, per GS general buyer guidance: Buyer registration basics (GS Knowledge, 2024–2025).

- Suppliers: Membership tiers/benefits exist for exposure and verification, but pricing is typically sales‑quoted rather than publicly listed; see GS Knowledge context on marketplace participation: Supplier/membership context (GS Knowledge, 2024–2025).

Limitations and how to mitigate

- No platform‑level escrow found: stage payments (deposit/balance tied to inspections), consider L/C for larger orders, and never pay off‑platform to unknown entities. GS’s own anti‑fraud page outlines common pitfalls: Anti‑fraud guidance (GS Knowledge, 2024–2025).

- Badge scope isn’t product compliance: validate CE/FCC/RoHS with issuing bodies; run pre‑shipment inspections and, where applicable, lab tests.

- Response variability: Always contact multiple suppliers; keep a response log (time to first reply, completeness of quote, willingness to discuss CAPA). Drop slow or evasive vendors quickly.

- Show dates/logistics can change: verify via GS show microsites close to travel. The 2025 dates cited here are from venue and MEHK listings.

Practical red flags checklist

- Certification copies with mismatched company names or expired dates

- Unusually low quotes (≥20% below cluster median) without a clear BOM/process reason

- Refusal to disclose tooling ownership or to accept third‑party inspections

- Bank account details not matching the licensed company name

- Pushback on Incoterms clarity or warranty terms

Due‑diligence playbook (condensed)

- Shortlist 6–10 suppliers with Verified badges; request cert copies and export references.

- Send a structured RFQ with specs, compliance targets, and sample/testing expectations.

- Evaluate samples against a rubric; run lab tests when compliance is mandatory.

- Negotiate MOQs/price breaks, set lead‑time commitments, and stage payments to inspections.

- Book AQL inspections and validate certificates with issuers; document defects and enforce rework.

- Pilot run before scale; maintain a CAPA log.

Verdict: Who should use Global Sources (and who shouldn’t)

- Strong match: electronics and mobile‑adjacent buyers who value a curated shortlist and can attend (or at least leverage) the Hong Kong shows for in‑person verification.

- Consider alternatives: if platform‑level escrow is non‑negotiable or if you need the broadest possible supplier universe, Alibaba is preferable; for industrial categories with higher MOQs and deeper factory profiles, include Made‑in‑China.

Ready to grow your business? Let us help you source products safely and efficiently. Visit Yansourcing to get started today.