Understanding how to look up HTS codes is crucial for businesses and individuals involved in international trade, as incorrect HTS code assignments can lead to costly delays and errors in the customs process.

This article will provide a thorough overview of the HTS classification system, tips on finding the correct HTS code for your product, and best practices for using HTS codes in international trade.

What Is an HTS Code?

An HTS code, or Harmonized Tariff Schedule code, is a standardized numerical method of classifying goods in international trade.

It is used by customs authorities around the world to determine the applicable duties, taxes, and other regulatory requirements for a particular product.

HTS codes are assigned to specific categories of goods based on their physical characteristics, intended use, and tariff classification of similar products.

The HTS code is typically used in conjunction with a country’s import and export regulations to determine the applicable taxes and duties for a particular product.

Overall, it is an important tool for businesses and individuals involved in international trade, as it helps to ensure that the correct duties and taxes are applied to imported and exported goods.

What Is the Difference Between an HTS Code and an HS Code?

An HTS code and an HS code are both codes used to classify goods in international trade. The terms HTS and HS are often used interchangeably, and they refer to the same thing.

The HTS (Harmonized Tariff Schedule) is a standardized system of names, codes, and rates used by countries to classify goods in international trade.

It is used to determine the applicable tariff rate for a particular product being imported or exported.

The HTS is maintained by the World Customs Organization (WCO), an intergovernmental organization that serves as a forum for the development and implementation of customs-related policies and practices.

The HS (Harmonized System) is the basis for the HTS. It is a standardized system of names and codes for classifying goods in international trade that was developed by the WCO.

The HS is used by most countries around the world to classify goods for customs purposes and to determine the applicable tariff rate.

Overall, the HS is the system that provides the codes and definitions for classifying goods, while the HTS is the system that assigns specific tariff rates to those goods based on the HS codes.

Both the HS and HTS codes are used to facilitate international trade and help ensure that goods are properly classified and taxed.

Why Is It Important to Know How to Look up HTS Codes?

There are several reasons why it is important to know how to look up HTS codes:

Reason 1: Compliance

Accurate HTS code assignment is essential for compliance with customs regulations.

Incorrect HTS code assignment can lead to errors in the customs process, which can result in costly delays and penalties.

Reason 2: Duties and taxes

HTS codes are used to determine the applicable duties and taxes for a particular product.

Knowing how to look up the correct HTS code can help to ensure that the correct duties and taxes are applied, which can have a significant impact on the cost of international trade.

Reason 3: Classification disputes

Disputes over the correct HTS code for a particular product can arise between customs authorities and importers or exporters.

Having a thorough understanding of the HTS code lookup process can help to avoid or resolve these disputes.

Reason 4: Trade negotiations

HTS codes are often used as a basis for trade negotiations and agreements between countries.

Knowing how to look up HTS codes can be beneficial for businesses and individuals involved in these negotiations.

Overall, knowing how to look up HTS codes is an important skill for anyone involved in international trade.

It helps to ensure compliance with customs regulations, minimizes the risk of errors and delays in the customs process, and can have a significant impact on the cost of international trade.

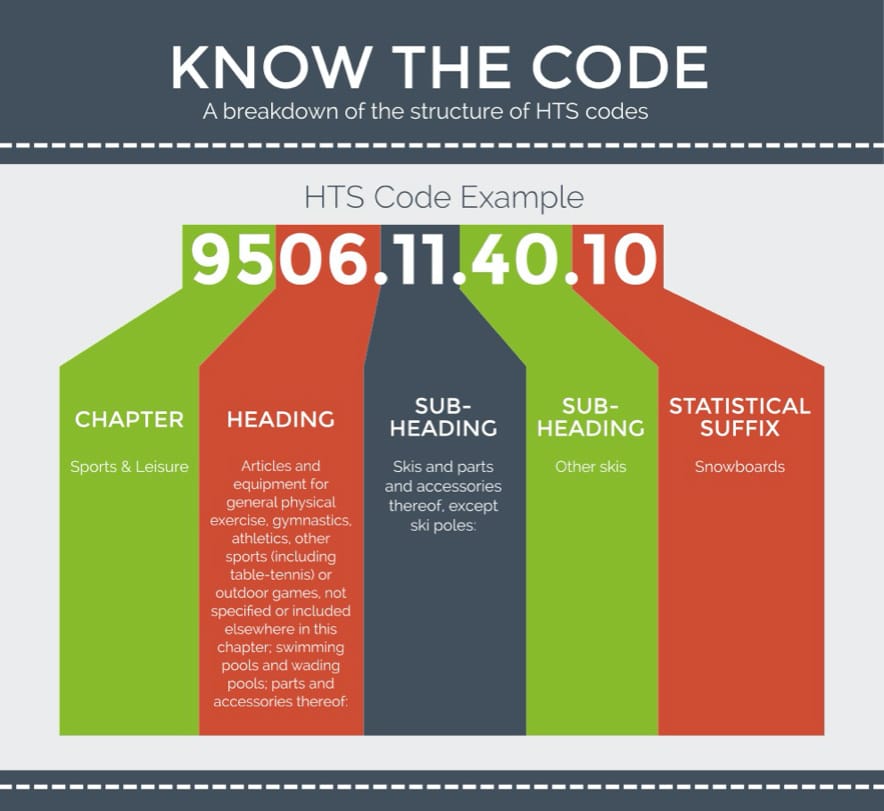

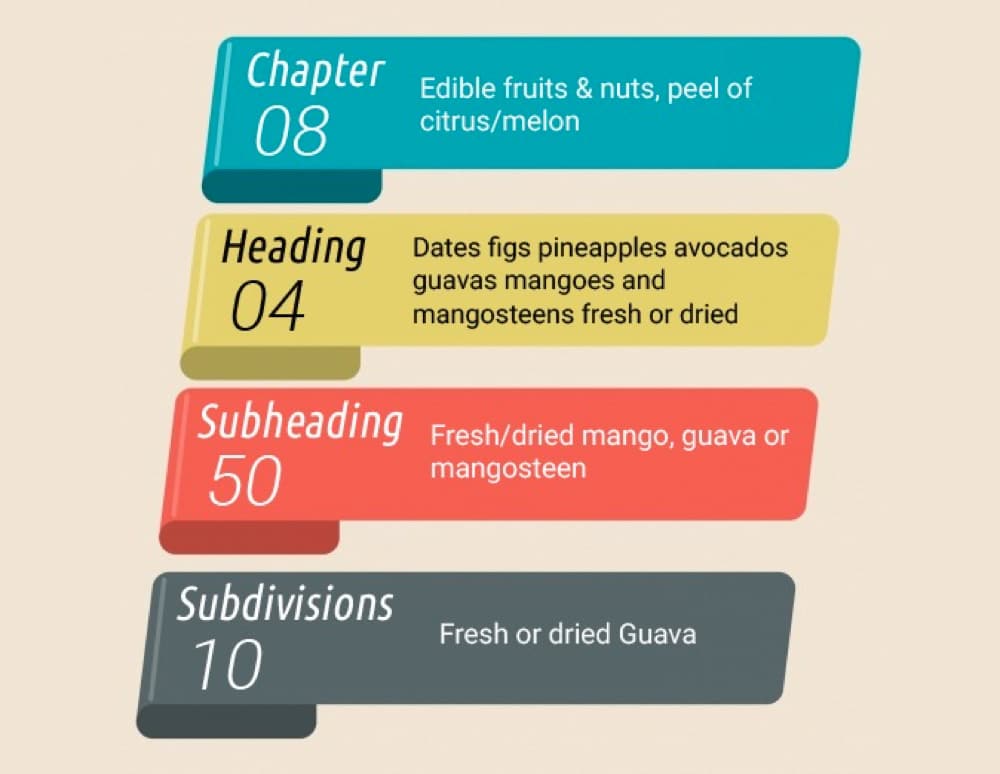

How Is the HTS Organized and Structured?

The HTS is a comprehensive system that covers virtually all goods that are traded internationally.

It is organized into a series of sections, chapters, and headings, with each level of classification representing a more specific category of goods.

The sections of the HTS are numbered from 01 to 99 and represent broad categories of goods.

Within each section, goods are further classified into chapters, which are numbered from 01 to 97. Chapters are divided into headings and subheadings, which are numbered from 01 to 99.

In addition to the numerical classification system, the HTS also includes an explanatory notes section, which provides additional guidance on the interpretation and application of the classification system.

The explanatory notes are updated periodically to reflect changes in the HTS classification system and to provide additional clarification on specific goods.

Overall, the HTS is a complex and detailed classification system that is designed to cover a wide range of goods and products.

Understanding how the HTS is organized and structured is important for accurately classifying goods in international trade.

What Are the Different Levels of Classification in the HTS?

There are three main levels of classification in the HTS: sections, chapters, and headings.

Level 1: Sections

The sections of the HTS are numbered from 01 to 99 and represent broad categories of goods, such as textiles, machinery, and vehicles.

Each section is further divided into chapters, which represent more specific categories of goods within the section.

Level 2: Chapters

Chapters are numbered from 01 to 97 and represent more specific categories of goods within the sections.

For example, the “Textile and Textile Articles” section (Chapters 50-63) includes chapters on woven fabrics, knitted fabrics, carpets, and other textile floor coverings, and apparel and clothing accessories.

Level 3: Headings and subheadings

Headings and subheadings are numbered from 01 to 99 and represent the most specific categories of goods within the chapters.

For example, the “Carpets and other textile floor coverings, tufted, whether or not made-up” heading (57.03) includes subheadings for specific types of tufted carpets, such as those made of wool or synthetic fibers.

How Do You Determine the Correct HTS Code for Your Product?

The Harmonized Tariff Schedule (HTS) is a standardized system for classifying goods in international trade.

The correct HTS code for a product is determined by the specific characteristics of the product, including its composition, form, and intended use.

To determine the correct HTS code for your product, you can consult the HTS code list published by the World Customs Organization (WCO).

This list is available online and is organized by commodity and subheading. It provides detailed descriptions of the various commodities and their corresponding HTS codes.

Alternatively, you can also use a classification tool or seek the assistance of a customs broker or other trade professional to help you determine the correct HTS code for your product.

Overall, it is important to accurately classify your product under the correct HTS code, as this can affect the duties and taxes that apply to your product when it is imported or exported.

What Resources Are Available to Help with HTS Code Lookup?

There are several resources available to help with HTS code lookup:

Resource 1: World Customs Organization

The World Customs Organization (WCO) publishes the Harmonized Tariff Schedule (HTS) code list, which is a standardized system for classifying goods in international trade.

The HTS code list is available online and is organized by commodity and subheading, with detailed descriptions of the various commodities and their corresponding HTS codes.

Resource 2: U.S. International Trade Commission

The U.S. International Trade Commission (USITC) also provides access to the HTS code list, as well as other resources to help with HTS code lookup, on their website.

This includes a searchable database of HTS codes and descriptions, as well as guidance on how to classify goods for tariff purposes.

Resource 3: Other customs agencies

Many countries also have their own customs agencies that provide access to the HTS code list and other resources to help with HTS code lookup.

For example, in the United States, the U.S. Customs and Border Protection (CBP) agency provides access to the HTS code list and other trade-related resources on its website.

Resource 4: Commercial classification tools and services

In addition to the above resources, there are also a number of commercial classification tools and services available that can help with HTS code lookup. These tools and services may charge a fee for their services.

Overall, it is important to accurately classify your product under the correct HTS code, as this can affect the duties and taxes that apply to your product when it is imported or exported.

If you are unsure of the correct HTS code for your product, you can seek the assistance of a customs broker or other trade professional to help you determine the correct classification.

How Are HTS Codes Used in International Trade?

Harmonized Tariff Schedule (HTS) codes are used in international trade to classify goods and determine the applicable duties and taxes that apply to them.

The HTS is a standardized system for classifying goods that are used by most countries around the world.

HTS codes are used to classify goods for tariff and trade purposes, and are typically based on the specific characteristics of the goods, such as their composition, form, and intended use.

The correct HTS code for a particular product is determined by consulting the HTS code list, which is published by the World Customs Organization (WCO) and is available online.

In order to import or export goods, businesses must accurately classify their products under the correct HTS code.

This information is typically provided on customs documents, such as commercial invoices, and is used by customs authorities to determine the applicable duties and taxes for the goods.

In addition to being used to determine duties and taxes, HTS codes are also used for statistical purposes, to track the flow of goods between countries, and to monitor trade trends.

What Impact Do HTS Codes Have on Customs Duties and Taxes?

Harmonized Tariff Schedule (HTS) codes are used to classify goods for tariff and trade purposes.

And the correct HTS code for a particular product can have a significant impact on the customs duties and taxes that apply to it.

Customs duties are taxes that are levied on imported goods and are typically based on the value of the goods and the applicable HTS code.

The HTS code determines the specific rate of duty that applies to a particular product, and this rate can vary depending on the country of origin and destination of the goods.

In addition to customs duties, imported goods may also be subject to other taxes and fees, such as value-added taxes (VAT) or excise taxes.

The applicable tax rate for a particular product may also be determined based on its HTS code.

Overall, it is important to accurately classify your product under the correct HTS code in order to ensure that the correct duties and taxes are applied.

If you are unsure of the correct HTS code for your product, you can seek the assistance of a customs broker or other trade professional to help you determine the correct classification.

How Often Are HTS Codes Updated and Changed?

Harmonized Tariff Schedule (HTS) codes are periodically updated and changed to reflect changes in the characteristics and composition of goods, as well as changes in trade policies and agreements.

The HTS code list is published by the World Customs Organization (WCO) and is updated every year.

In addition to annual updates, the HTS code list may also be amended at other times as needed to reflect changes in the characteristics of goods or changes in trade policies.

It is important to keep track of updates and changes to the HTS code list in order to ensure that your product is accurately classified under the correct HTS code.

This is particularly important for businesses involved in international trade, as the correct HTS code can affect the duties and taxes that apply to a particular product.

Overall, If you are unsure of the correct HTS code for your product, you can consult the latest version of the HTS code list.

Or seek the assistance of a customs broker or other trade professional to help you determine the correct classification.

How Can You Stay Up to Date on HTS Code Changes?

There are several methods to stay up to date on changes to the Harmonized Tariff Schedule (HTS) code list:

Method 1: Subscribe to updates from the World Customs Organization

The WCO publishes the HTS code list and is responsible for updating it on a regular basis. You can subscribe to updates from the WCO to receive notifications of changes to the HTS code list.

Method 2: Follow trade-related news sources

Many news sources cover developments in international trade, including changes to the HTS code list.

Following these sources can help you stay informed about changes to the HTS code list and other trade-related developments.

Method 3: Consult with a customs broker or other trade professional

Customs brokers and other trade professionals are often informed about changes to the HTS code list and other trade-related developments.

Consulting with one of these professionals can help you stay up-to-date on HTS code changes and other trade-related matters.

Method 4: Use a classification tool or service

There are a number of commercial classification tools and services available that can help you stay up-to-date on changes to the HTS code list. These tools and services may charge a fee for their services.

Overall, it is important to stay up-to-date on changes to the HTS code list in order to ensure that your product is accurately classified under the correct HTS code.

This is particularly important for businesses involved in international trade, as the correct HTS code can affect the duties and taxes that apply to a particular product.

What Are Common Mistakes and Challenges When Looking up HTS Codes?

There are several common mistakes and challenges that businesses can face when looking up Harmonized Tariff Schedule (HTS) codes:

1. Incorrect classification

One of the most common mistakes when looking up HTS codes is incorrectly classifying a product under the wrong code.

This can occur if the product’s characteristics or intended use are not accurately described, or if the correct code is not selected from the HTS code list.

Incorrect classification can result in incorrect duties and taxes being applied to the product.

2. Lack of knowledge about the product

Another challenge when looking up HTS codes is a lack of knowledge about the specific characteristics and intended use of the product.

This can make it difficult to accurately classify the product under the correct HTS code.

3. Complexity of the HTS code list

The HTS code list can be complex, with many different codes and subheadings.

This can make it challenging to determine the correct HTS code for a particular product, especially if the product falls into a category that is not clearly defined or has multiple potential classifications.

4. Changes to the HTS code list

The HTS code list is periodically updated and changed to reflect changes in the characteristics and composition of goods, as well as changes in trade policies and agreements.

This can make it difficult for businesses to stay up-to-date on the latest HTS codes and ensure that their products are accurately classified.

Overall, to avoid these mistakes and challenges, it is important to carefully review the characteristics and intended use of your product.

And consult the latest version of the HTS code list or seek the assistance of a customs broker or other trade professional to help determine the correct classification.

How Can You Avoid Making Mistakes in HTS Code Lookup?

There are several steps you can take to avoid making mistakes in Harmonized Tariff Schedule (HTS) code lookup:

Step 1: Review the characteristics and intended use of your product

Before looking up the HTS code for your product, carefully review its characteristics and intended use.

This information is important for determining the correct HTS code, as it is based on the specific characteristics of the product.

Step 2: Consult the latest version of the HTS code list

The HTS code list is published by the World Customs Organization (WCO) and is updated on a regular basis.

It is important to consult the latest version of the HTS code list to ensure that you are using the most current codes.

Step 3: Seek the assistance of a customs broker or other trade professional

Customs brokers and other trade professionals are knowledgeable about the HTS code list and can assist you in determining the correct HTS code for your product.

Step 4: Use a classification tool or service

There are a number of commercial classification tools and services available that can help you determine the correct HTS code for your product. These tools and services may charge a fee for their services.

Overall, it is important to accurately classify your product under the correct HTS code in order to avoid mistakes and ensure that the correct duties and taxes are applied.

If you are unsure of the correct HTS code for your product, it is advisable to seek the assistance of a customs broker or other trade professional to help you determine the correct classification.

What Are Some Tips and Best Practices for Successful HTS Code Lookup?

Here are some tips and best practices for successful Harmonized Tariff Schedule (HTS) code lookup:

Tips 1: Understand the characteristics and intended use of your product

Before looking up the HTS code for your product, it is important to understand its specific characteristics and intended use.

This information is key to determining the correct HTS code, as it is based on the specific characteristics of the product.

Tips 2: Use a reliable source for HTS code information

It is important to use a reliable source for HTS code information, such as the HTS code list published by the World Customs Organization (WCO).

This will help ensure that you are using the most current codes and descriptions.

Tips 3: Consider seeking the assistance of a customs broker or other trade professional

Customs brokers and other trade professionals are knowledgeable about the HTS code list and can assist you in determining the correct HTS code for your product.

Tips 4: Use a classification tool or service

There are a number of commercial classification tools and services available that can help you determine the correct HTS code for your product. These tools and services may charge a fee for their services.

Tips 5: Keep track of updates and changes to the HTS code list

The HTS code list is periodically updated and changed to reflect changes in the characteristics and composition of goods, as well as changes in trade policies and agreements.

It is important to stay up-to-date on these changes to ensure that your product is accurately classified under the correct HTS code.

Overall, by following these tips and best practices, you can increase the chances of successfully looking up the correct HTS code for your product and ensure that the correct duties and taxes are applied.

How Do You Ensure Your Products Use the Correct HTS Codes?

There are several steps you can take to ensure that you are using the correct Harmonized Tariff Schedule (HTS) code for your product:

Step 1: Review the characteristics and intended use of your product

Before looking up the HTS code for your product, carefully review its characteristics and intended use.

This information is important for determining the correct HTS code, as it is based on the specific characteristics of the product.

Step 2: Consult the latest version of the HTS code list

The HTS code list is published by the World Customs Organization (WCO) and is updated on a regular basis.

It is important to consult the latest version of the HTS code list to ensure that you are using the most current codes.

Step 3: Seek the assistance of a customs broker or other trade professional

Customs brokers and other trade professionals are knowledgeable about the HTS code list and can assist you in determining the correct HTS code for your product.

Step 4: Use a classification tool or service

There are a number of commercial classification tools and services available that can help you determine the correct HTS code for your product. These tools and services may charge a fee for their services.

Step 5: Keep track of updates and changes to the HTS code list

The HTS code list is periodically updated and changed to reflect changes in the characteristics and composition of goods, as well as changes in trade policies and agreements.

It is important to stay up-to-date on these changes to ensure that your product is accurately classified under the correct HTS code.

Overall, by following these steps, you can increase the chances of using the correct HTS code for your product and ensure that the correct duties and taxes are applied.

Conclusion

The HTS Code lookup is a useful tool for businesses and individuals who need to know the classification of goods for international trade.

It is important to use the correct HTS Code when shipping goods internationally, as it can affect the amount of taxes and duties that must be paid.

The HTS Code lookup can help to ensure that the correct code is used, and that goods are properly classified for international trade.

We are Yansourcing, a leading sourcing company in China, dedicated to helping our clients source products from China at the most competitive prices. If you are interested in importing from China, please feel free to contact us.

FAQs

1. What is an HTS code?

An HTS Code (Harmonized Tariff Schedule Code) is an internationally recognized system of codes used to classify goods for import and export.

It is used by customs authorities around the world to identify the correct tax rate and duty for a particular item.

2. What is the purpose of an HTS code?

HTS codes (Harmonized Tariff Schedule codes) are used to classify goods for import and export.

They are used to determine the rate of duty that will be applied to a particular item when it is imported into a country.

HTS codes are also used to track international trade data and to ensure that goods are properly classified for taxation and other regulatory purposes.

3. Are HTS codes updated regularly?

Yes, the HTS code list is periodically updated and changed to reflect changes in the characteristics and composition of goods, as well as changes in trade policies and agreements.

It is important to stay up-to-date on these changes in order to ensure that your product is accurately classified under the correct HTS code.

4. How do I find the HTS code for a specific product?

The best way to find the HTS Code for a specific product is to search the Harmonized Tariff Schedule (HTS) database.

The HTS is a global system of nomenclature that is used to classify traded goods. The HTS database can be searched by keyword, product description, or HTS code.

5. What is the difference between an HTS code and a product code?

An HTS code is used to classify imported goods for tariff and duty purposes, while a product code is used to identify a specific product.

6. What is the difference between an HTS code and a Schedule B number?

An HTS code is used to classify imported goods for tariff and duty purposes, while a Schedule B number is used to classify exported goods for statistical purposes.