Do you want to buy products from China but don’t know whether you will be charged at customs? Of course, anyone who imports goods from China must pay import duty.

Especially for the beginners, knowing import duty from China can help them include it in their estimates to make decisions related to profitability.

After reading this article, you will be able to know what import duty from China you need to pay and how to calculate them.

What Is Import Duty?

Import duty, also known as customs duty, is the tax imposed by customs authorities on goods imported into a country, or more precisely say, which is an indirect duty imposed by Customs and Border Protection (CBP) on the consumers of imported goods.

Usually, the value of the imported goods determines the amount levied on them. That is, the duty is generally calculated as a rate or percentage of the value of the imported item.

Import duty varies from product to product and is determined based on several different factors, including:

- Product’s value

- Product’s weight

- Product’s size

- Product’s country of origin

However, import duty isn’t to be confused with consumption duty levied on manufacturers producing and selling goods domestically.

Like import duty, consumption duty is indirectly charged. The cost of consumption duties is often passed on to the end-user by increasing the cost of the goods.

What Import Duty from China Do You Need to Pay?

You will have to pay import duty when you import products from China. The amount of the import duty from China to your country depends on your product’s commodity or TARIC code.

However, import duties and surcharges vary greatly in different countries.

The imported product generally consists of the following taxes:

- Value Added Tax (VAT)

- Consumption taxes

- Duties

1. Pay for the prescribed VAT rate

The importer must pay VAT on the customs value and import duty when importing from China.

The customs value is the total cost of the product, including the expenses you pay to the supplier, shipping to your domestic warehouse, and any import duties.

Make sure you pay any VAT due. If you are VAT registered, you must pay VAT, but you can claim it back on your standard VAT return.

You will usually receive a C79 certificate from HMRC showing that you have paid the import VAT.

However, the situation is different if you import from China to the USA. You need to pay two types of tax instead of VAT as follows:

a. Merchandise Processing Fee (MPF)

It varies depending on the value of the imported goods.

If the product’s value is less than $2,500, the packaging fee can be charged at $2, $6, or $9, while if the product’s value is higher than $2,500, the fee is 0.3464% of the value, usually with a minimum charge of $25 and a maximum charge of $485.

b. Port Maintenance Fee (HMF)

It is charged only for goods arriving by sea, which amounts to 0.125% of the product’s value. These special duties are calculated based on FOB prices, which consider the product’s cost and the transportation fee.

So, when importing products from China, it is important to know the import duties, customs fees, and clearance documents.

2. Consumption tax

Consumption tax is levied on luxury goods and specific items (such as oil or alcohol and tobacco), usually on top of VAT.

So, the price with VAT must be multiplied by the consumption tax again. You do not have to pay if your product is not included in these items.

Consumption tax is paid as a percentage of the estimated value or by volume.

The payment of consumption tax is made every month, not on each shipment. The rate of this tax varies greatly from product to product.

3. Duties

Duties are calculated as a percentage of the product’s value as declared on the bill of lading. However, these percentages are different for each product and may also be affected by anti-dumping duties.

In other words, products are taxed according to the numerical code (H.S.) specified on the invoice issued by the supplier.

What Is the Import Duty Rate from China to USA?

As an importer, “Made in China” is a great option. The products are cheaper, and many can be sold locally or online for huge profits.

Import duty from China to USA depends on the products and goods you imported, making the international trade process difficult for new importers.

Each item imported into the USA receives a different import duty rate depending on whether it is for commercial or non-commercial use, weight, how it is used, where it is made, etc.

Each product must undergo a process called determining the classification of these rates.

However, on June 15, 2018, United States Trade Representative (USTR) released a list of products imported from China that will be subject to additional duties.

The USA will impose additional duties of 25% on approximately $34 billion worth of Chinese products containing important industrial technologies because they are related to the “Made in China 2025” industrial policy.

The rule of thumb for imposing duties on products imported into the USA from China is that if your product’s H.S. code begins with the numbers 9003-9006, it will be considered an electronic item and subject to a 6 percent duty.

If you import clothing that costs more than $5,000 FOB per order, you will be subject to 27% duties and additional state taxes.

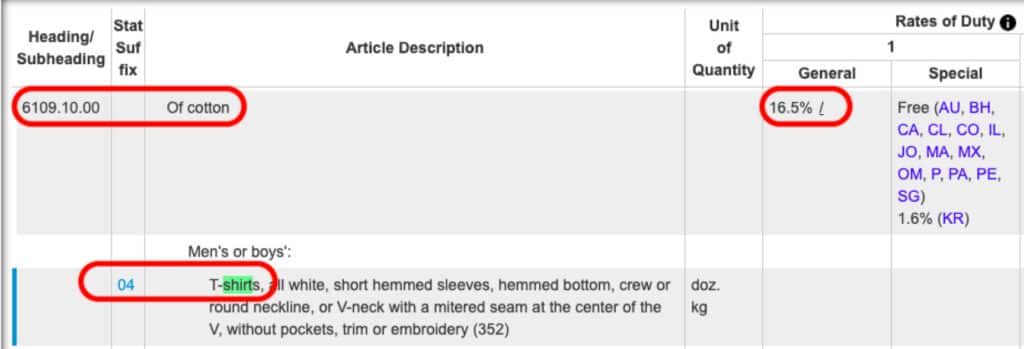

1. Clothing import duty from China to USA

All imported clothing is taxable if it costs $200 and above. The duty rate for standard clothing is 16.5%, and it can be more expensive for genuine wool and fur clothing, including coats and jackets.

2. Bicycles import duty from China to USA

Bicycles from China are cheaper than other bicycles because of labor costs, but with the USA-China trade war, Trump has increased duties on bicycles imported from China to the USA by up to 30%.

3. Watches import duty from China to USA

The duty range of imported watches from China is from 9.8 to 11% because of the general and special taxes imposed on these items. However, only the general duty is payable if the special duty rate is invalid.

If your goods’ gross or volumetric weight is less than 10 kg per cubic meter, you will be charged a duty of 5% of the CIF value and transportation and insurance costs.

This general rule of thumb may vary depending on the product type, country of origin, and other specifications required by CBP.

When you import from China to the USA and want to calculate import duty only, it is recommended that you search for the H.S. code, HTS, or product code for that individual product (these are the same).

How to Use HTS Code to Check Import Duty from China to USA?

HTS codes refer to Harmonized Tariff Schedule codes, also known as Harmonized Tariff Schedule of the United States (HTSUS), which can replace Schedule B numbers for USA exports.

They are 7 to 10 numbers classification codes, and the internationally standardized H.S. code system determines the first six.

The USA uses the HTS coding system, and their HTS codes include four numbers in addition to the original six numbers in the H.S. code.

The first two additional numbers are the USA subheadings in the H.S. code, which determine the duty on imported products.

The last two are used for trade statistics and have no role in product identification. Currently, there are over 17,000 HTS codes used for USA imports and exports.

Let me give you a quick tip if you know your product’s material construction, performance, and function. You should be able to read the description of the HTS code and find the code that makes the most sense.

Because some products have similar functions but may be constructed and used differently, the result is a different duty rate, and you may face duty-free or be taxed.

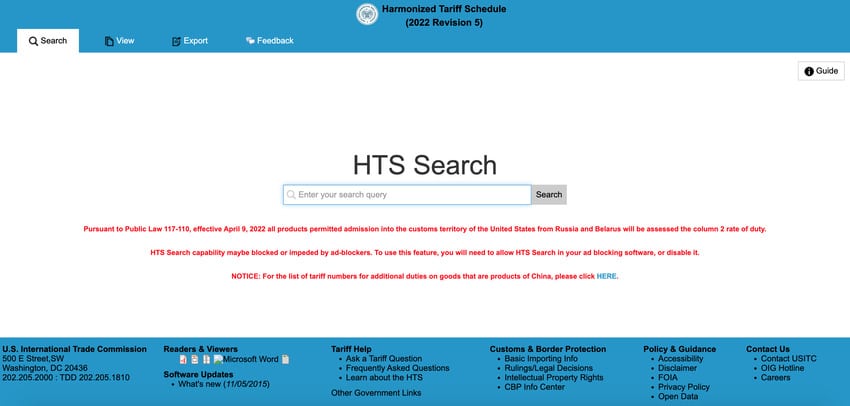

HTS Code Lookups

To comply with USA import and export regulations, you must know how to find HTS codes for your products.

Here is a helpful resource to look up your HTS codes – the HTS Code Search Tool from USA International Trade Commission.

You can also download a soft copy of the HTSUS 2018 edition. Please note that there are over 3844 pages to sift through.

We suggest you identify your section and download the appropriate selection for your trade product to facilitate your search.

In short, finding the correct HTS code can be complicated and confusing, no matter how experienced. It can lead to significant penalties if done wrong.

How to Calculate Import Duty from China?

All goods imported from China are subject to import duties, and the rates depend on current legal requirements by country.

Knowing the current import duty rates and how to calculate them based on the unique specifications of your goods can help you prepare for the cost and achieve a more seamless and stress-free shipping experience.

To calculate the import duty from China to your country, you need to check the H.S. codes of the products. Each H.S. code has its rate, and you will have to pay duties based on it.

Step 1. Find the H.S. code of the product

1. What is H.S. code?

H.S. stands for Harmonized System Code, a global multifunctional product nomenclature established by the WCO (World Customs Organization). It is used to find the type of goods you import from other countries.

2. What is the difference between H.S. codes and HTS codes?

H.S. codes have six numbers as a common standard, while HTS codes have 7 to 10 numbers. HTS codes are unique after the initial six numbers, which means that the importing country usually determines these codes.

3. How to check the H.S. code?

To check the H.S. code of a product, you have to go to the HTC official website and write down the query in the search box. Then you will get the result.

It consists of the following:

- 6 numbers code identifier

- 5000 product categories with 99 pieces

- Each chapter has 21 sections

- Arranged in a logical structure

- Define clear standard classification rules

Step 2. Check import duty rates online

Many websites can use to look up import duty rates online, but the safest way is directly on the USITC website (the United States International Trade Commission).

You can find the H.S. code of the product by the name and then check the import duty rate.

Step 3. The duty calculation formula

Now, you have found the duty rate based on the H.S. code, and then you can calculate the duty using the following formula.

Import duty = product value * import duty rate

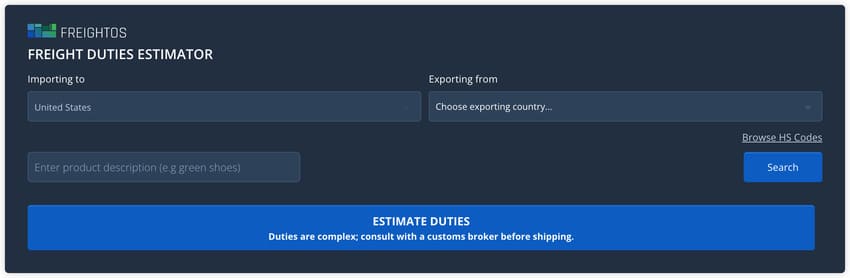

Step 4. Use the duty calculator

If you are having trouble with this, you can use Freightos. A simple duties calculator can help you calculate the import duty from China to your country.

How to Pay Import Duty from China?

The Customs will automatically notify you or your courier if you need to pay import duty on goods from China.

They will tell you how much you need to pay and when to pay it, so you don’t need to worry about doing the math yourself.

Payment of import duty from China to your country is related to the following shipping method:

1. By postal service (China Post/H.K. Post/EMS)

When your package arrives at the post office, you will need to pay the duty and handling fees owed to the postman and go to your local post office.

2. By express service (DHL/UPS/TNT/FedEx)

When your goods are valued at $800 or more and are shipped via international courier, it is convenient for you to pay import duty because the express company will pay for you in advance, and you only need to pay the courier company afterward.

3. By air or sea freight

The import clearance process is complicated if your goods are shipped by air or sea rather than to your door.

In this case, you’d better buy the services of a local customs agent. They will help you prepare the documents to declare your goods upon arrival.

There are usually two ways to pay your import duties:

- Pay directly to the customs agency.

- Pay through your shipping company, which will pay in advance and request settlement before the final delivery of the product.

How to Avoid or Reduce Import Duty from China?

Can I avoid the duty on import from China? The short answer is. No, you can’t. No matter the products are imported from China to which country, there are always duties and fees to pay.

The closest option to avoid import duties is to negotiate DDP Incoterms with your supplier. The supplier will be responsible for all shipping, insurance, and duties in this case.

However, there are several ways you can reduce import duty from China. The amount you pay for duties depends on various factors, while controlling these factors can lead to greater profit margins and help you save.

Here are some tips for reducing import duty from China:

1. Hire a licensed customs broker

When importing from China, customers first ask how to clear customs at the border. The answer is to hire a good customs broker.

They should know the rules and regulations for importing goods from China and get the job done safely, quickly, and economically. This will allow you to focus on selling your goods and getting paid.

2. Find competitively priced suppliers

Countless manufacturers compete for your business. If you don’t find a good price or product quality that meets your needs, source and sift through suppliers until you find them.

The most popular platforms for sourcing Chinese suppliers include:

- Alibaba

- Global Sources

- DHgate

- Alibaba

- Made in China

3. Negotiate favorable shipping terms

Shipping terms, also known as Incoterms, determine who arranges and pays for the freight and customs charges.

There is no standard or managing agency to regulate shipping terms, so you must clarify with your supplier who is responsible for these charges.

The following are the most common 11 Incoterms:

- ExWorks (EXW)

- Free Carrier (FCA)

- Carriage Paid To (CPT)

- Carriage & Insurance Paid To (CIP)

- Delivered at Place Unloaded (DPU)

- Delivered at Place (DAP)

- Delivered Duty Paid (DDP)

- Free Alongside Ship (FAS)

- Free on Board (FOB)

- Cost & Freight (CFR)

- Cost, Insurance & Freight (CIF)

You may learn more on our blog for Incoterms for details below:

What are Incoterms? | The Complete Guide 2022

4. Packaging your products effectively

Properly packaging your products is important in cross-border shipments. Remember to choose the suitable packing materials and methods for your products and cushion them properly to protect them well.

This help prevents your products from being damaged in transit, and they can save you money on replacing damaged goods and ultimately improve your customer experience with satisfied customers.

Import Duty from China FAQ

1. What are the import duties from China to USA?

China is a huge market for producing goods, and import duty from China to the USA is a trendy topic. There are different types of duties that you have to pay. The duty rate is based on imported products from China to the USA.

There are two formulas for calculating the duty, depending on the form:

- Customs Value * Customs Duty Rate

- Quantity Imported * Customs Duty Rate

Tips: Most of the time, you need to add a tax rate, which may be 25% or 7.5%.

The calculation is given above. You can calculate the import duty from China to USA depending on the product you want to import.

2. How do the high USA duty affect import from China?

The USA government’s high duty rates on imported products hurt both countries. The American public feels that Trump’s duty rates are imposed on buyers.

Luckily, China has lowered the product price to absorb the high duty rate to reduce the buyer’s burden.

If this duty rate goes down, the trade will automatically increase, which will also help consumers. The duty rate should be low, which is good for both countries.

3. Who pays the customs duty, whether the consignor or the consignee?

The USA imposes duties on imported goods, and the registered importer is responsible for paying duties. In other words, the consignee of the goods is responsible for paying the duties.

4. How are import duties paid?

There are two ways to pay import duty:

- Pay directly to the customs agency.

- Through your shipping company, pay in advance and request settlement before the final delivery of the product.

5. What is the difference between import taxes and import duties?

When people talk about import duties, they usually refer to import taxes. This is mainly because import duties comprise the overall import tax amount.

Import taxes are made up of the following components:

- Import duties (based on commercial value and H.S. code or HTS code)

- Merchandise Processing Fee (MPF) – the product value multiplied by 0.3464%.

- Port Maintenance Fee (HMF) – product value multiplied by 0.125% (applies only to goods shipped by sea)

6. What is the difference between H.S. code and HTS code?

In the import/export world, you will often hear the terms H.S. Code and HTS Code used interchangeably.

HTS Codes or H.S. Codes are part of international trade’s global standardized cargo classification system. They are also referred to as Harmonized System codes or duty codes.

H.S. codes have six numbers as a common standard, while HTS codes have seven to ten numbers.

HTS codes are unique after the initial six numbers, which means that the importing country usually determines them.

Import Duty from China Conclusion

Importing from China can be a worthwhile, exciting, and sometimes challenging effort. For those who want to import from China, it is essential to understand the import duty from China.

If import duty from China seems too complicated for you, try to contact a customs broker, ask your carrier, or contact us. We will take care of your entire supply chain so you can focus on promoting sales.

I am Yan, the founder of Yansourcing, the best sourcing agent in China, who can quickly and safely help you buy and import from China.