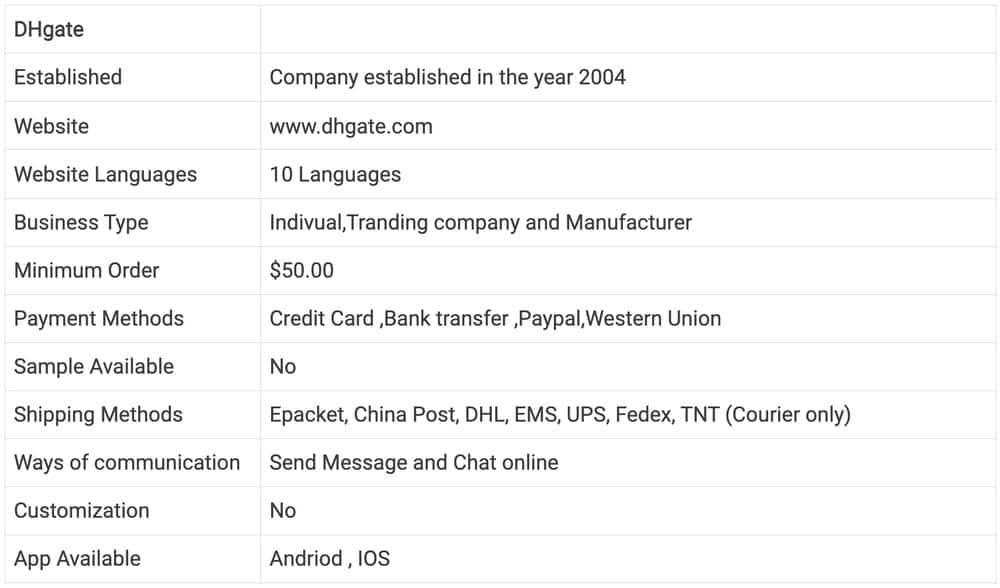

The first step in importing from China to the UK is to find a supplier who can easily ship your products overseas. This might take some time if you are not familiar with a supplier in China, so you must do some research before contacting anyone.

What benefits of importing from China to UK?

There are many benefits to importing from China.

First, you can find cheaper prices than any other country in the world. This makes it very easy for your business to sell products at competitive prices.

Second, there are so many products to choose from when it comes to these imports. When you import from China, you will never run out of options!

The main advantage of importing from China to the UK is its low cost. Prices are usually much lower than in the USA and other Western countries, although some product quality may be sacrificed.

Although there are additional costs for importing from China, such as shipping costs, it is still a viable and economical option.

For example, you can import electronics and other products at a lower price than if you were to buy them in UK.

Sourcing from China also gives you new products that are not available in the local market.

How to find a reliable supplier in China?

1) Top 6 China wholesale websites

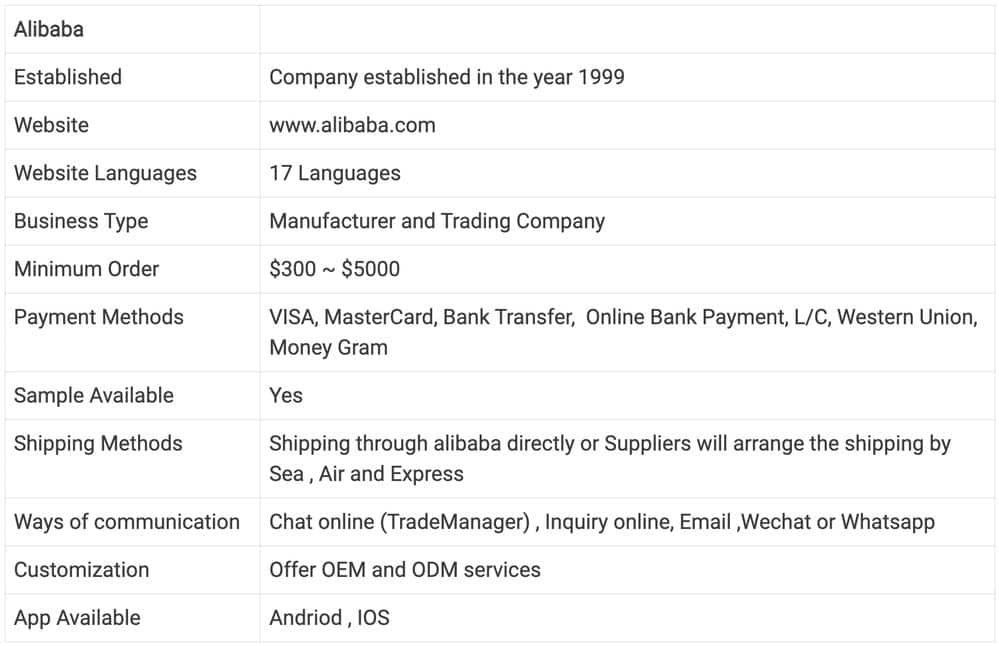

Alibaba

Even if you are a new wholesaler, you should know Alibaba. Alibaba is one of the largest wholesale websites in China. Alibaba suppliers offer wholesale products, OEM and ODM.

Learn More about Alibaba.com

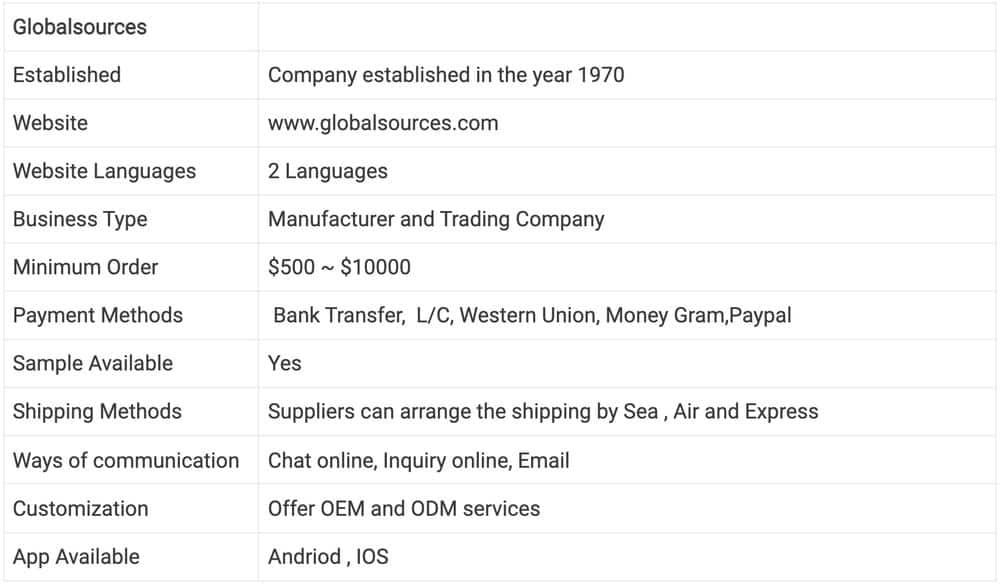

Global Sources

Global Sources is also a very famous wholesale website in China. Global Sources has tens of thousands of Chinese suppliers. You can find any products on the Global Sources.

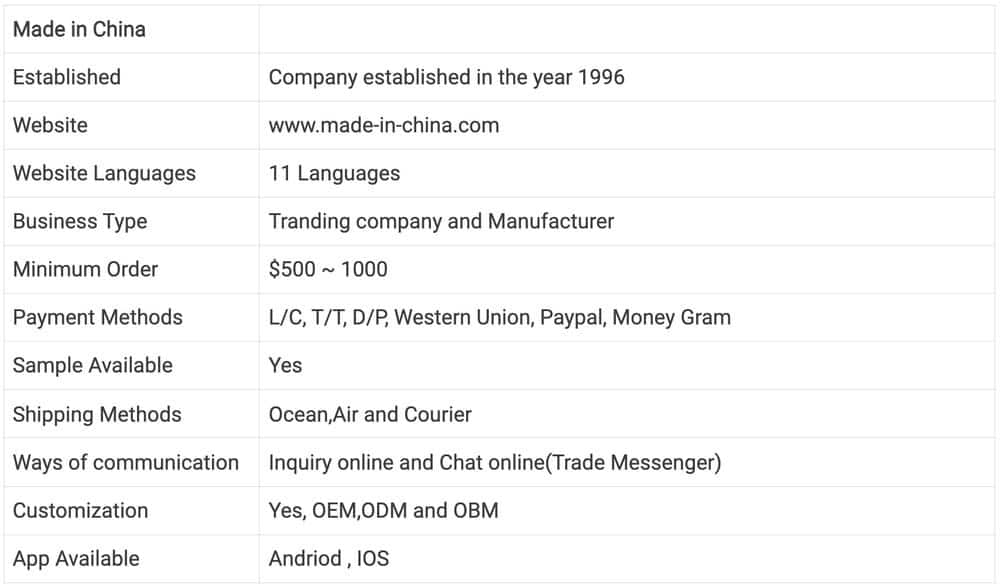

Made in China

Made-in-China is also one of the famous wholesale websites in China. Made-in-China’s reputation is not as big as Alibaba’s, but it has tens of thousands of suppliers, I am sure you can find the products you want.

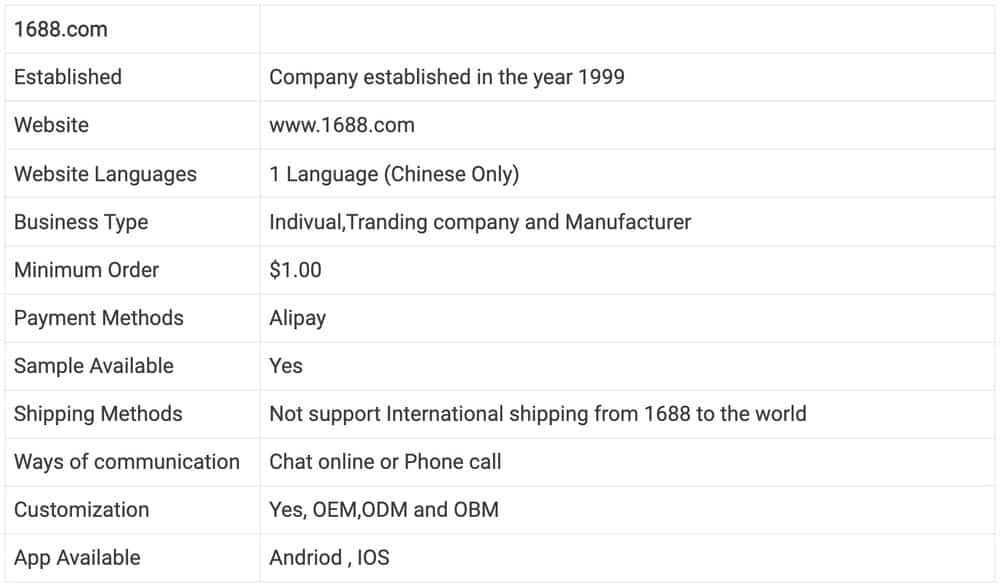

1688.com

1688.com is a subsidiary of Alibaba Group. This wholesale website is cheaper than other websites, but it only supports the Chinese language.

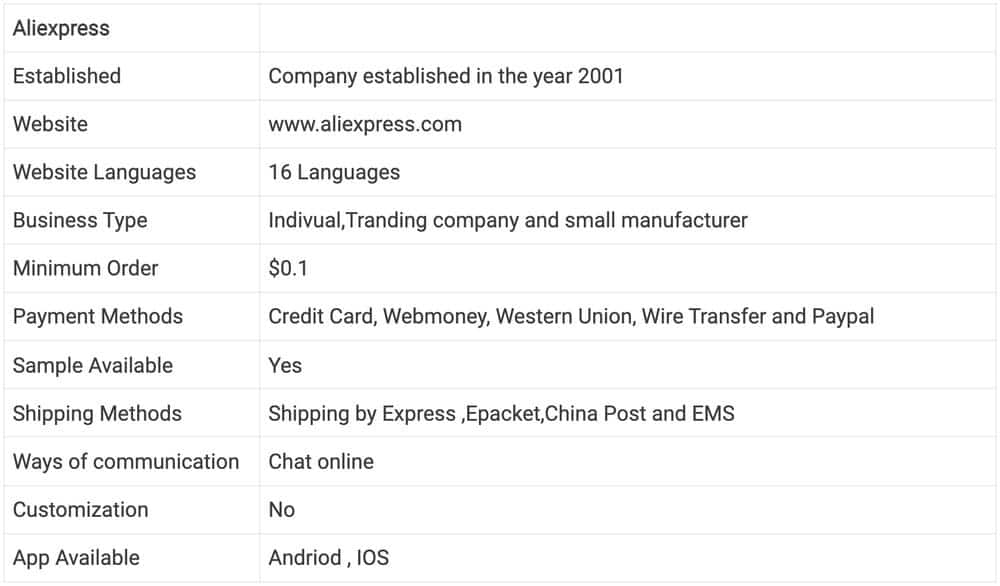

Aliexpress

AliExpress is also part of the Alibaba Group, a website that provides global trade for small business owners and consumers. It is an online shopping site with over 20 million sellers and 220 million buyers.

Learn More about Aliexpress.com

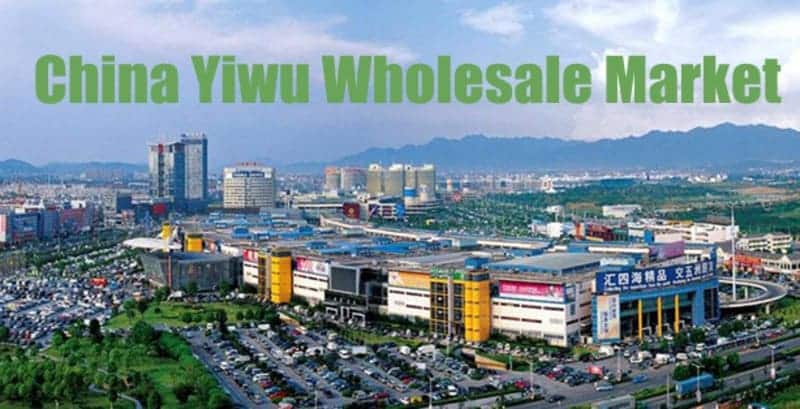

DHgate

DHgate is an online wholesale website in China, it has existed for more than 12 years and sells products to buyers all over the world. DHgate is one of the 2100 most popular websites in the world.

Learn More about DHgate.com

2) China wholesale markets

A. Wholesale Markets in Guangdong

Guangzhou is the largest trade center of the Chinese capital now. It owns the most industries categories among cities and industries in South China. Baiyun International Airport is China’s busiest international airport.

You can easily find concentrated marketplaces of clothing, kitchenware, lighting, toys, shoes, leather watches, furniture, etc.

Learn More about Guangdong Wholesale Market

B. Wholesale Markets in Yiwu

Yiwu International Trade Town also known as the Yiwu Market, is one of China’s largest small industry export bases. is the primary wholesale market complex in Yiwu, Zhejiang, China.

According to the World Bank, it is the world’s largest small commodities market.

Learn More about Yiwu Wholesale Market

3) How to research your potential suppliers?

Do some research to find suppliers in China that might be a good fit for your business. It is recommended that you use at least three or four suppliers to compare prices, quality, and speed of shipping.

4) How to ask suppliers the right questions?

Before committing to any transaction with your potential supplier, ask them the right questions.

Find out if they are willing to ship via courier if you need the product by a certain date, or if there is a minimum order volume you need to meet to get free international shipping.

You should also ask what payment methods they accept – for example, via bank transfer, PayPal, Western Union, etc.

What tips for negotiating with suppliers?

1) Ask for discounts in advance

It is important to negotiate before you place your order, not after. If the supplier offers a discount in advance, this may indicate that they are confident in their product and want to get it out quickly.

2) Ask for samples before placing your order

This will give you an idea of the quality of the product and allow you to see what best fits your specifications.

3) Compare prices between suppliers

To find the right deal for you.

4) Negotiate with your suppliers in a respectful manner

If they feel backed into a corner, they may break off communication or refuse to provide the product at all.

5) Ask for delivery by courier if needed

What is the shipping cost from China to UK?

If you are planning to import from China to the UK, then you have many options for shipping methods.

Some of the methods you can choose from include air freight, sea freight, air mail, door-to-door delivery, EMS courier, and express delivery.

All of these have their own pros and cons, depending on the value of your product.

Air freight is fast but expensive, while door-to-door delivery or EMS courier is inexpensive but slow.

What is the tax for importing goods into UK?

1) Duty and taxes

The UK Customs department requires that any goods being imported into the country be subject to tax.

This includes both duty and VAT, depending on what type of transaction it is as well as where they’re coming from (EU or outside).

There’s no VAT charged when shipping within Europe.

When you purchase goods from outside of the European Union, such as China or India, there will likely be some taxes that need to be paid.

2) UK duty

The amount of duty you will pay depends on the type of goods, as each product has a different duty.

You can ask your freight forwarder or use the online tariff on the UK government website, to calculate it yourself.

https://www.gov.uk/trade-tariff

3) HS code

Any goods imported into the UK are subject to an HS code so that you can calculate the duty.

You will need a detailed description of the product in order to determine which tariff category your goods fall into.

With this, you can calculate the correct UK duty and VAT.

4) VAT

Except for duty, you also need to pay VAT. Many people think that the VAT is calculated on the cost of goods only, but this is wrong.

VAT is calculated on the total cost of shipping the goods to the UK, which consists of the supplier’s cost of goods plus shipping cost and customs duty.

You will pay VAT on the total cost incurred in shipping the goods to the UK.