For companies or small business owners involved in importing, knowing the landed cost of your international transactions is a key factor in making strategic business decisions.

It would help if you calculated the landed cost to understand the total cost of your goods. This blog post will explain landed cost, why it’s important, and how to calculate it.

What Is Landed Cost?

Landed cost is a total cost associated with the shipping process of the product. It includes transportation, raw materials, and additional costs, such as import duties, insurance, and other related costs.

In this case, landed costs are the total amount of all these additional fees and costs.

It is calculated on a per-unit basis and reflects the total cost of each unit, not the cost of the entire shipment. The unit can be defined by individual product, volume, and weight of the item.

Once you calculate landed costs, you will find less obvious costs, and you can eliminate them from your supply chain. With this information driving your decisions, you can get products to buyers cost-effectively.

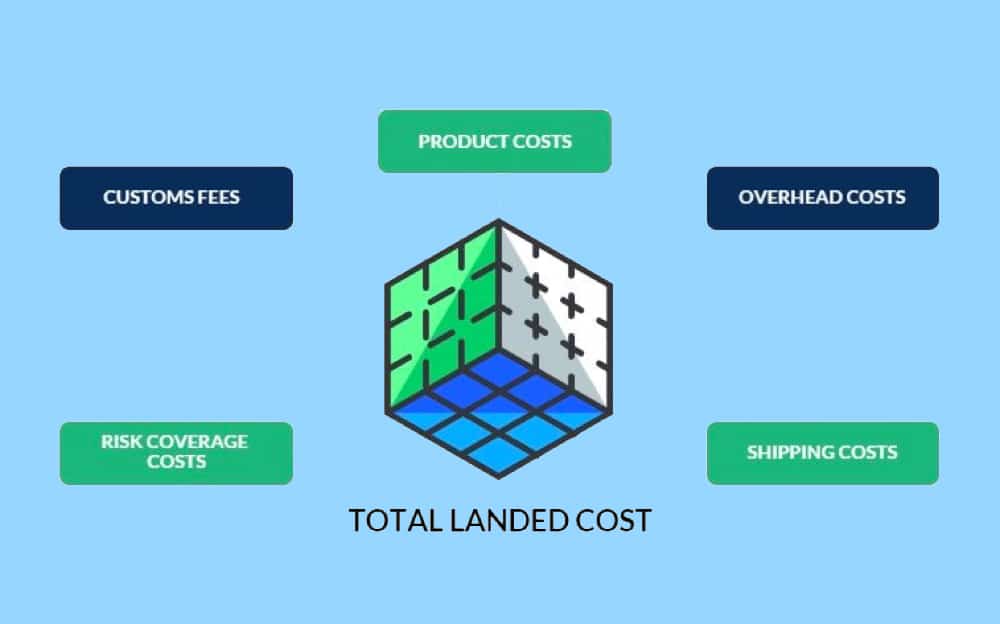

What Are the Components of Landed Cost?

Landed costs are the total costs of landed goods. It includes all specific prices associated with the shipment of each item.

For example, the original price of the product, shipping or transportation charges, duties, taxes, insurance, crating fees, handling and payment fees, and even any other fees required for currency conversion.

Let’s take a closer look at what landed costs include.

1. Product cost

The most obvious cost is the cost of the product itself. Start with the price per unit you must pay the supplier to get these items. The commercial invoice you need for international shipping will indicate this price.

2. Transportation costs

Transportation costs are not as straightforward as the price of the product, as they may consist of several different costs and vary depending on the mode of transportation. Such as packaging, handling, transportation, and other costs.

Also, international transportation may include special transportation charges, port handling charges, and transportation to the final destination.

3. Export licenses

Some products may require an export license or permit, which may increase your landed cost.

Be sure to do the research and apply for special permits/licenses as early as possible to avoid delays, additional costs, and legal issues.

4. Value Added Tax (VAT)

VAT is charged on purchasing goods or services that require transportation across borders.

The term VAT corresponds to the costs incurred at each production stage, from raw material purchase to transportation.

5. Custom Duty

Custom is synonymous with import duties, port charges, and similar fees.

These customs Duties are subject to change, so you must keep abreast of your country’s trade agreements, which ports are used, and anything else that might affect costs.

Delaying payment at this stage can delay your whole shipment and slow your supply chain.

6. Risk coverage costs

Accidents can happen no matter how good the suppliers and shipping companies are.

For example, imported goods may not be up to standard, and the crating company may pack poorly.

These can be attributed to insurance costs, as well as any other quality assurance and compliance costs, which is the cost paid by the buyer or seller to get the package safely to its final destination.

7. Warehousing Fees

If your shipment stays at the dock longer than the free allocation, you may have to pay storage fees, known as demurrage charges.

For example, if your shipment waits longer than expected for transportation, unloading, or customs clearance, then your shipment may exceed the free storage limit.

8. Indirect Costs

Indirect costs include any other costs associated with your e-commerce business’s day-to-day operations. They are:

- Inventory carrying costs

- Employee wages/salaries

- Payment processing fees

- Exchange rates

While some of these costs are easy to forget or overlook, keeping them in your mind will help determine if you are running a profitable business.

Why Is Landed Cost So Important?

Landed cost is every cost for moving a product through the supply chain to its final destination. There are obvious and hidden costs in getting any product to the customer.

Performing a landed cost analysis on all your shipments is critical, which gives you a comprehensive view of your costs and helps you make more informed decisions.

1. Optimize product pricing

Understanding your landed costs will allow you to evaluate your business performance, maximize your pricing, and ensure you know exactly how much you are paying for your inventory.

2. Reduce expenses

Regarding international transportation, the lowest-priced product isn’t always the best deal because other factors are involved in the shipping process.

Calculating landed costs requires you to look at the costs of shipping your product, which may reveal opportunities to reduce costs.

3. Purchasing decisions

From a buyer’s view, it’s important to understand landed costs when comparing competing products.

For example, buying from overseas at a lower cost than domestically may seem like a better deal.

However, international shipping costs, customs fees, cross-border taxes, and insurance should also be added, as these can represent a significant portion of a company’s budget.

In short, you know your total landed costs will have insight into financial performance.

You will be able to see your product spending and find ways to improve it, which gives you a better understanding of costs and the cost trade-offs associated with making changes throughout your supply chain.

Why Is Landed Cost Difficult to Calculate?

If you are running a multi-product store, landed cost calculations are not easy.

Data shows that most shippers say they didn’t calculate landed costs because they don’t have the data, resources, or time available, so it can be difficult to calculate.

Reason 1. Landed costs can be time-consuming to determine all the factors before setting up a calculation.

Many companies do not have the time to perform calculations that should be confirmed before making a decision.

Reason 2. Other factors that add complexity are the uniqueness of each project’s landed cost.

Depending on the product, the calculations are different. The landed cost calculation model must be flexible and must be updated from time to time.

Reason 3. Another difficulty in calculating landed costs is that many people do not know how long of a link in the supply chain they should include in this equation.

There is no specific formula, so it is challenging to determine if everything has been included. It isn’t easy to know the actual value of what must be included and what is not.

How to Calculate Landed Cost?

Understanding all the different costs and charges involved in the whole procurement and import process is important.

Landed costs are complex, so you want to gather as much data as possible from your shipping, warehouse, and other links.

More importantly, you want to understand all the cost components involved when importing so you don’t get caught up in the costs you haven’t considered.

Here is a guide on calculating the landed cost of imported products.

Step 1: Receive a detailed quotation from the exporter

This quotation should include the following details:

- Details of Shipper and consignee

- Value of the goods

- Trade Terms (Incoterm®) and location

- Port of Loading (POL) and Port of Discharge (POD)

- Currency (most often USD)

- Product details and price

- Product HS/HTS code

- Exchange rate (ROE)

Step 2: Get a packing list

This list should include the following:

- Product and package dimensions

- Type of cargo (by full container – FCL, or LCL cargo)

- Tariff code (if tariffs apply)

- Customs VAT

- Method of transport

- Number of pieces

- Net weight

- Gross weight

- Billable weight (remember to calculate by shipping method)

Step 3: Know about international shipping costs and extra import fees

You can contact a freight forwarder to get an honest quote to ship your product to your location.

Remember, most suppliers sell goods based on EXW Incoterm® (Ex-works) or FOB Incoterm® (Free on board).

You may learn more on our blog for EXW Vs. FOB for details below:

EXW Vs. FOB: What is the Difference? How do They Work?

Freight forwarders’ quotes usually itemize all costs involved, which include the following:

1. Sea freight charges from the port of loading to the port of discharge (usually in US dollars).

Note that ocean and air freight rates change throughout the year, so you must confirm your validity dates.

2. Local charges in the importing country (calculate these charges in your local currency).

Include local port handling charges, domestic trucking, customs clearance, quarantine, documentation, marine insurance, etc.

3. Local import duty rate. This requires you to provide the HS code of the goods to be imported, and the freight forwarder or customs broker can confirm what tax rate will be applied to the imported goods.

Also, ensure how import duties will be levied on your product. This process varies from country to country; some products are imported duty-free.

4. Find the local tax rate (VAT / GST) and how the imported goods will be charged.

Step 4: Understand the actual foreign currency exchange rates and fees

There are many options for making foreign currency payments to international suppliers. You must clearly understand the real exchange rate your currency exchange provider can offer you.

Please note that your secure rate should be lower than the current interbank rate.

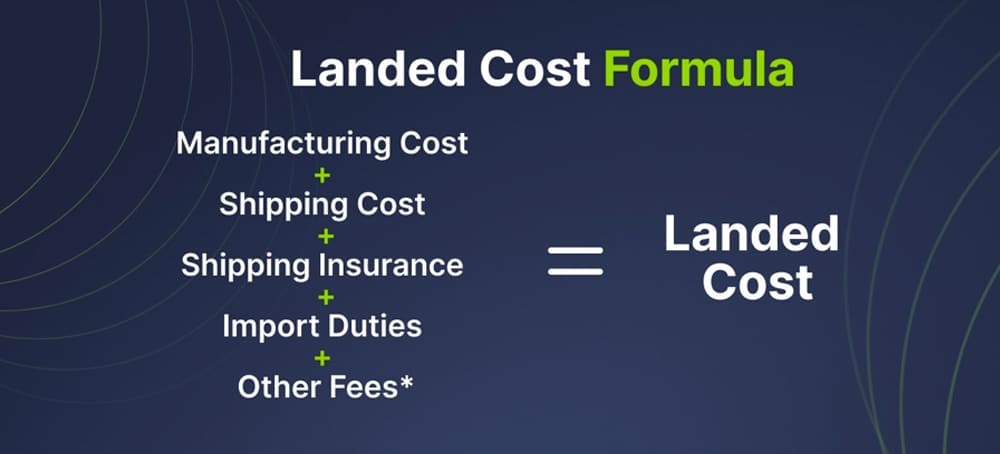

In short, the above steps are necessary to calculate your landed costs. Here, we will give you a formula for reference, that is:

landed cost = purchase price + international transportation + import duties + domestic delivery + risk insurance + miscellaneous overheads

How Can I Reduce the Landed Cost?

Sometimes after calculation, you will find the landed cost is high, and you will want to reduce it. But how can you do this?

Here are some tips to reduce the landed cost of your product:

1. Communicate with your suppliers

If you can get the lower cost of raw materials (or lower the price you pay for finished goods), you can also lower your landed costs.

It can be one of the more complex ways to reduce your landed costs unless many different suppliers compete for your business.

2. Optimize your warehouse processes

Optimizing your warehouse processes is a more practical way to reduce landed costs. The more efficiently your warehouse team can handle your products, the more you can reduce the landed cost.

3. Choose Yansourcing

The best way to reduce the landed cost of your products is to work with Yansourcing.

Yansourcing can find you the most reliable suppliers and competitive prices, offering a comprehensive multi-channel e-commerce fulfillment service to efficiently handle your warehousing, shipping, and general fulfillment requirements to reduce your landed costs.

You may learn more on our blog for Yansourcing’s Service for details below:

Introduction of Our Services and Charges

The Benefits of Using Landed Cost Tracking Software

Many wholesalers and distributors import products who rely on accurate landed cost tracking software to determine the actual cost of their inventory, which is also especially true for importers and exporters.

Landed cost tracking software enables them to correctly record, manage and allocate the landed cost of goods.

Landed cost tracking software has many benefits, including:

- Identify all price components associated with imported goods to better estimate landed costs.

- It can accurately track actual product costs.

- Support the estimated landed cost of each product with correct cost-sharing of quantity, value, volume, etc.

- It can maintain target margins without accidents due to undetermined costs.

- It can track the arrival dates of shipment.

- Pre-calculate the cost of goods for efficient receipt.

- Have multiple tariff codes.

- It can track component costs to match invoices correctly.

- Automatically update predictable arrival dates once shipment dates are modified.

- Save on manual tracking costs and time to correct errors.

- Archiving completed shipments and associated costs.

Landed Cost FAQ

1. What is the landed cost?

Landed costs are the total costs of delivering the product to the buyer’s doorstep, including transportation, duties and taxes, and other costs.

2. What is the difference between FOB and Landed Cost?

FOB is the price the buyer pays the supplier for the products.

Usually, it excludes international transportation and import charges and only includes little freight (factory to port), export packaging, and documentation fee.

While landed cost includes all the costs of shipping the product. In short, landed cost is a more comprehensive measure than FOB.

Landed Cost Conclusion

By paying close attention to landed costs, you will be able to budget more accurately than ever.

Calculating landed costs isn’t one of the more exciting aspects of running a business, but it is critical, especially for sustainable growth.

I am Yan, the founder of Yansourcing, the best sourcing agent in China, who can quickly and safely help you buy and import from China. If you have any questions about importing from China, don’t hesitate to contact us.