If your $50k–$200k order depends on new molds or dies, your payment schedule shouldn’t move without inspection evidence. Tie cash to QC gates and you dramatically cut quality, delay, and “tooling hostage” risk.

Why inspection-linked payment milestones reduce risk

Think of payments as a series of green lights. Each light turns on only when an independent inspection says the lot meets your standards.

That keeps incentives aligned: the factory earns releases by proving conformity; you pay for verified results.

Here’s the deal: A simple rework loop avoided early can save more than your inspection budget.

On a $100k order, catching defects at a During Production Inspection (DUPRO) can prevent scrap and rework that easily runs 5–10% of order value.

Providers define DUPRO around 30–50% completion—early enough to fix systemic issues without derailing the entire schedule, as noted by SGS’s guidance on DUPRO timing.

And because acceptance is grounded in AQL sampling under ISO/ANSI tables, you’re not arguing opinions—you’re applying a standard.

For fundamentals, see QIMA’s AQL overview.

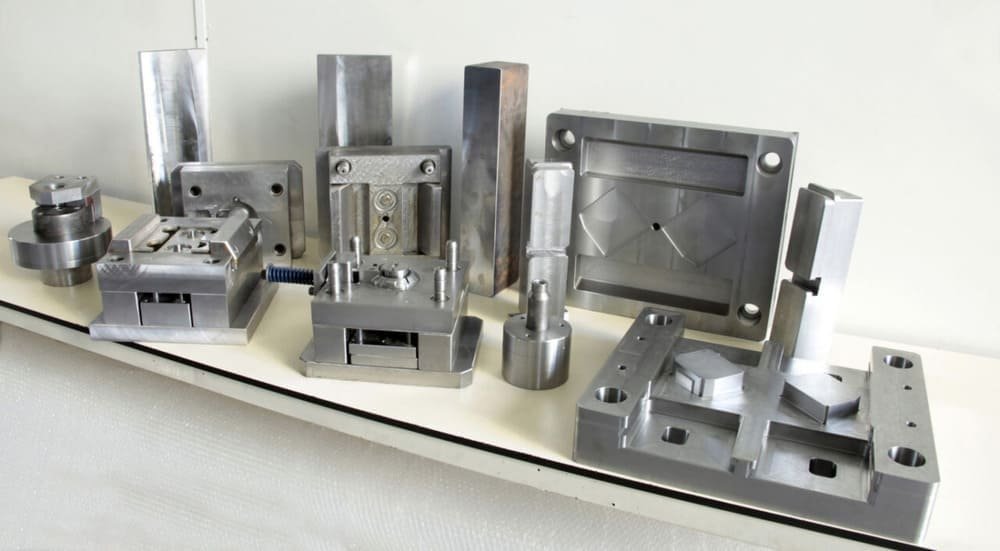

The dual-track tooling + production payment structure

Mid-size OEM projects with new molds/tooling benefit from two parallel tracks: Tooling (NRE) and Production. Structure each to release funds only when QC evidence is in hand.

- Conservative template (higher control):

- Tooling NRE: 30% at PO + tool design package; 30% after T1 with dimensional report; 30% after T2 with corrected deviations and process window; 10% after golden sample and pilot run validation.

- Production: 10% materials deposit after incoming material verification; 30% after IPC/early-line check; 30% after DUPRO pass; 30% after PSI pass and export packing verified.

- Balanced template (common for experienced suppliers):

- Tooling NRE: 40% at PO; 40% after T2 pass with measurement report; 20% at golden sample approval.

- Production: 30% deposit; 40% after DUPRO pass; 30% after PSI pass.

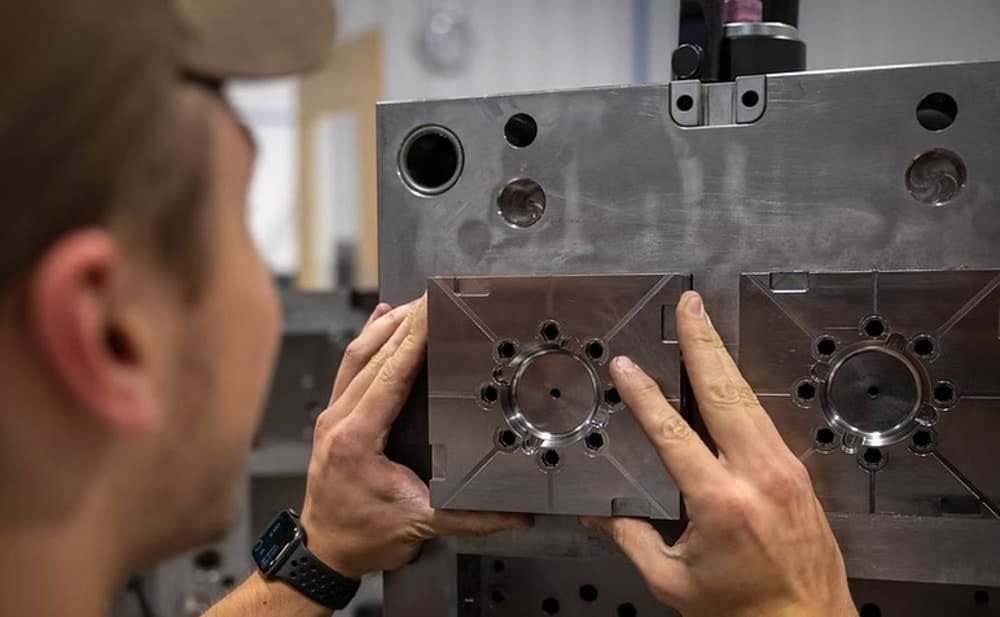

Acceptance evidence should reference trial conventions used in injection molding: T1/T2/T3 as progressive tool validations. For context on trial stages and process validation, see Fictiv’s guide to rapid injection molding.

AQL and inspection gates you’ll actually use

Your playbook revolves around three practical gates:

- IPC/Initial Production Check: Validate materials, first-off parts, and line setup before scale. Use General Inspection Level II for sampling. Tie early deposits to IPC pass to avoid funding a flawed start. See QIMA’s IPC overview.

- DUPRO/During Production: At ~30–50% completion, sample against your chosen AQLs to catch systemic issues early. This inspection can unlock mid-stage payments or trigger rework before costs balloon. SGS describes DUPRO at 30–50%, aligning with practical control windows: SGS DUPRO service.

- PSI/Pre-Shipment: When 80–100% of units are finished and export-packed, PSI confirms quantity, workmanship, function, labeling, and packaging. This gate should control final payments and shipment release. For the final gate, review QIMA’s PSI page.

Default AQLs for general consumer goods often use Critical 0.0, Major 2.5, Minor 4.0 under ISO 2859-1 / ANSI Z1.4.

ISO 2859-1 remains the baseline scheme for attribute sampling; you choose General Level II, derive your code letter by lot size, and apply acceptance numbers from the table.

Budgeting note: third-party inspection costs in China are typically priced per man-day.

For reference, V-Trust lists all-inclusive rates of USD 268–298 per man-day in major regions, and charges missed inspection fees if goods aren’t ready on the scheduled day—helpful for planning and supplier accountability, per V-Trust’s pricing and terms and general terms.

Tooling protections: clauses that prevent hostage risks

Inspection-linked payments control quality risk; tooling clauses control custody and leverage. In mid-size projects, the last thing you want is a supplier retaining your molds when a dispute arises.

Prioritize:

- Ownership and exclusive use: Buyer owns tooling once specified payments are made. Tooling may be used only to produce buyer’s products; no duplicates or transfers.

- Identification and marking: Assign unique IDs, engrave markings, and attach photos; list tooling location and custodian.

- No lien / no setoff: Supplier has no right to retain tooling, raw materials, or finished goods for any claim; disputes go to the agreed forum without retention.

- Movement and return rights: Buyer may demand release and relocation within a defined timeline; supplier must prepare, crate, and hand over. Include liquidated damages for refusals.

- Maintenance and shot-life: Supplier maintains tooling to agreed shot-life; preventive maintenance logs are shared.

- Governance & language: Contracts governed by PRC law in Chinese language with proper chops/signatures; venue aligned to the factory location for enforceability. Obtain counsel review for localization.

Contract clause bank: inspection-linked payment release

Use the following copy-ready snippets (adapt to your contract style and seek counsel review):

- Condition precedent to payment: “Release of Milestone Payment XXX% is strictly conditioned upon receipt of an independent Inspection Report evidencing conformity to the Specifications and AQL Acceptance Criteria for the relevant lot (General Inspection Level II; Critical 0.0; Major 2.5; Minor 4.0), and, where applicable, verification of export packing.”

- Determinative inspection finding: “Findings in the Inspection Report issued by the named independent inspector shall be final and binding for the purpose of payment release, save for fraud or manifest error.”

- Rework and reinspection: “If the Inspection Report records a failure against the Acceptance Criteria, Supplier shall promptly implement corrective actions and rework at its cost. Buyer may withhold payment until reinspection records a pass. Reinspection costs incurred due to Supplier’s failure shall be borne by Supplier.”

- Tooling ownership and release: “Upon payment of the Tooling NRE amounts, all tools, molds, jigs, and fixtures listed in Annex ••• are the exclusive property of Buyer. Supplier shall not assert any lien or right of retention and shall release tooling within 555 business days upon Buyer’s written demand.”

- LC option with inspection certificate (UCP 600): “If payment is by documentary credit, the LC shall require presentation of an Inspection Certificate issued by SGS/BV/IntertekSGS/BV/IntertekSGS/BV/Intertek stating goods conform to contract specifications and quantity; the certificate shall be dated on or before shipment and examined under UCP 600.” For context on certificate terms under documentary credits, see ICC’s briefing on certificates in credits.

Worked examples: plastics vs. die-cast

- Injection molded consumer part (ABS enclosure, 5k units):

- Tooling track (balanced): 40% NRE at PO; 40% after T2 pass with dimensional report; 20% at golden sample approval.

- Production track: 30% deposit; 40% after DUPRO pass at ~50% completion; 30% after PSI pass.

- AQLs: Critical 0.0 (e.g., safety/functional defects), Major 2.5 (e.g., cracks, warping beyond tolerance), Minor 4.0 (e.g., small flow lines/cosmetic scuffs). Sampling: General Level II; code letter by lot size.

- Cadence: IPC to validate material and first shots; T2/T3 trials to stabilize process window; Golden Sample signed by both parties; pilot run validates repeatability; DUPRO catches systemic issues; PSI governs final release.

- Die-cast housing (ADC12 aluminum, 3k units):

- Tooling track (conservative): 30% NRE at PO; 30% after T1 with dimensional and porosity checks; 30% after T2 corrections; 10% after golden sample and pilot.

- Production track: 10% materials deposit after alloy certs; 30% after IPC; 30% after DUPRO; 30% after PSI.

- AQLs: Apply 0.0/2.5/4.0 with defect taxonomy guidance (gas porosity, cold shuts, misruns, shrinkage). Use visual standards and dimensional acceptance tied to drawings.

- Notes: Defect classification references like ASM’s international casting defects taxonomy help define what counts as Major vs. Minor. For cost context on die-casting tools, see RapidDirect’s die casting cost overview.

Practical support example — coordinating PSI and tooling handover

Disclosure: Yansourcing is our product.

A neutral example of how a sourcing agent can make this playbook operational:

For a $120k molded enclosure project, the buyer instructs the agent to schedule DUPRO and PSI against the contract’s AQL and sampling plan.

The agent books an independent inspector, confirms lot size and code letter, and circulates the checklist (specs, test methods, packaging photos).

After a DUPRO fail on warpage, the agent coordinates corrective actions and reinspection; once PSI passes with export packing verified, the final payment is released.

In parallel, the agent maintains a tooling registry (IDs, photos, custodian) and, upon contract termination, triggers the tooling release clause—organizing crating, handover documents, and carrier pickup from the factory within the agreed window.

No hype—just logistics and documentation done right.

Next steps

Finalize your two-track schedule, lock AQLs (0.0/2.5/4.0) with General Level II sampling, and make third-party reports determinative for payment release.

Add tooling clauses (ownership, no-lien, movement rights), and route the draft past counsel and a QC specialist.

If you need operational help coordinating inspections and tooling handovers, you can contact Yansourcing for neutral support.