Are you doing business with international customers and need to send money overseas?

When considering payment methods for cross-border trade, telegraphic transfer may be an option for you. This is one of the common methods of sending money internationally.

In this guide, we’ll tell you what telegraphic transfer is, how it works, and the fees. I hope it will help you to make better international transactions.

What Is a Telegraphic Transfer?

Telegraphic transfer, or TT payment for short, is an electronic payment method mainly used when you need to make an overseas transaction. It is also known as an electronic funds transfer or wire transfer.

Traditionally, a telegraphic transfer was a means of transferring funds between accounts using a cable, radio, or telephone.

Today, it has been replaced by computers and wireless networks that use a sophisticated network of intermediary banks and financial institutions to transfer funds between accounts.

Telegraphic transfers are sometimes referred to as electronic funds transfers (EFT), a more novel term.

Generally, telegraphic transfers take 2-4 days to complete, depending on the source and destination of the funds. Moreover, as per the actual demand, the bank will charge a fee.

What Are the Functions and Features of Telegraphic Transfer?

Initially, the name suggests that telegraphs were used to transfer funds between financial institutions. However, telegraphs have become obsolete.

Today, money transfers between institutions are usually done through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and use cash settlement in foreign currency.

This means the customer sends money to a designated account at a foreign exchange bank and requests payment within a certain period after delivery.

Below are all the functions and features related to wire transfer or TT:

- It is an electronic mode of transferring funds between accounts.

- It is commonly used for international fund transfers.

- It is executed on the SWIFT network through various financial institutions.

- It is a fast and secure mode of transferring funds abroad.

- Most of these international transfers are subject to fees.

- The transferred funds will convert from one currency to another.

How Does Telegraphic Transfer Work?

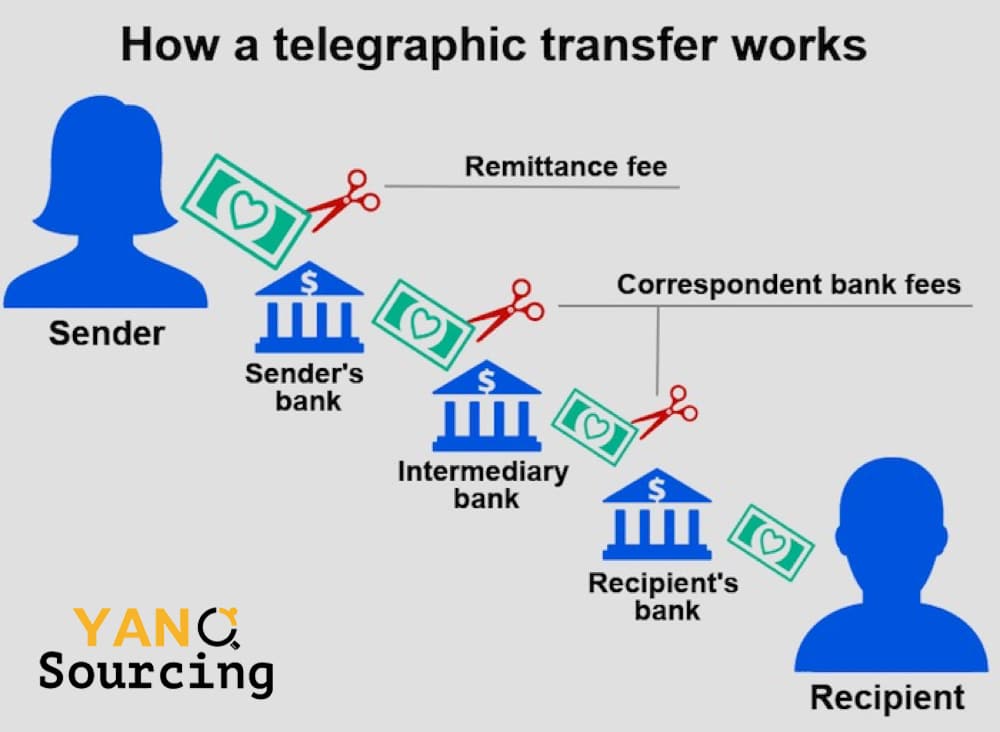

Telegraphic transfers are done electronically by transferring money between different banks until it reaches the destination.

Once the transfer is initiated at the source bank, the funds will be passed between banks with pre-existing relationships. These banks are called intermediaries or intermediary banks.

Here are usually 3 steps when sending a telegraphic transfer:

Step 1. The remitter instructs his bank to transfer the funds to a beneficiary in another country. The remitter can do this by visiting a branch or logging into an online banking service.

Step 2. The remitter’s bank will send the funds to a partner bank in the destination country. If the beneficiary’s account is with the same bank, the funds will be credited to his account, and the transaction is completed.

Step 3. If the beneficiary’s account is with another bank, the receiving bank will transfer the funds to the beneficiary’s bank to complete the transaction.

But the funds may go through two or more intermediary banks before finally reaching the beneficiary’s bank.

Is Telegraphic Transfer Safe?

Yes, telegraphic transfers are considered one of the safest ways to send money. As long as you choose a registered bank or money transfer provider, your telegraphic transfer is indeed secure!

However, as with all means of managing your money, telegraphic transfers are not guaranteed to be 100% safe.

Remember, you still need to be aware of money transfer scams and avoid sending money to people you don’t know. Once an unauthorized person receives the money, it will be hard to get it back.

In short, telegraphic transfer is a safe and convenient way to send money to people overseas, but be aware of what’s involved and the potential fees.

Telegraphic Transfer Pros and Cons

Telegraphic transfer is the most common method for transferring funds from one country to another and as with other payment methods, sending money in this way has its pros and cons.

Pros

- Widely used around the world

- Easy and simple operation process

- Safe and secure with multiple protections during the transfer

- Quickly completes the transfer process

- Less susceptible to exchange rate and international market fluctuations

- Lower service fees than other payment methods

Cons

- The speed of transferring is affected by many factors

- There is no fixed rate, depending on different banks

- Requires much information to confirm, which may cause unnecessary steps

- Not suitable for small transfers for small businesses

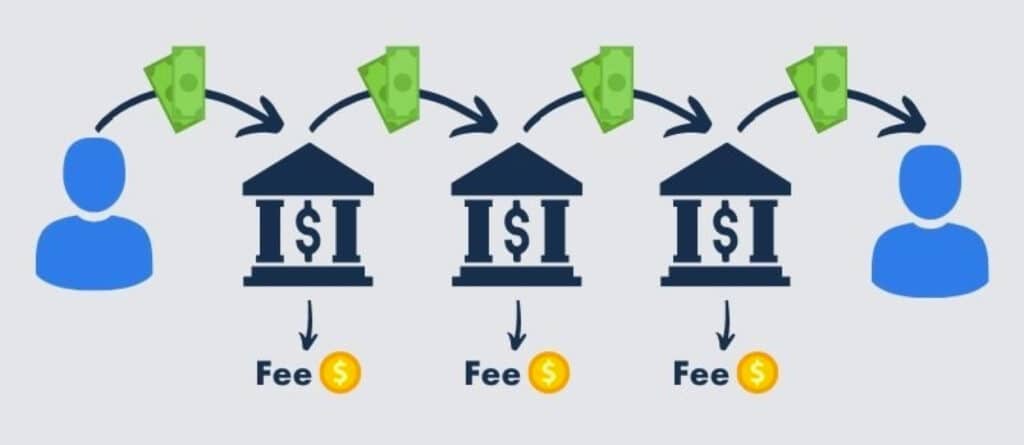

What Are Telegraphic Transfer Fees?

Telegraphic transfer fees are usually high, and depending on the number of banks involved, each bank can charge different fees.

Usually, the total fees can’t be predetermined, which will only become apparent after completing the transaction.

There are 4 different fees below, and each points to a separate entity:

Remitting bank fee

The remitting bank will charge fees based on your remittance, the amount, and the destination, within a few percent of your payment.

Intermediary bank fee

The intermediary bank will charge a fee considering the source and amount of the payment. This is part of the service fee, so the intermediary bank can help complete the transaction and feed it back to the remitting bank.

Currency conversion fee

Telegraphic transfers involve different currencies, so fees for exchange rates are necessary.

Receiving bank fee

Finally, the bank that receives and delivers the money to the recipient also charges fees.

In short, there are no specific and standard fees for telegraphic transfers. This is because several fees need to be paid in one transaction, which will vary somewhat depending on what currency you are sending and where you are sending it.

How to Make a Telegraphic Transfer?

Telegraphic transfer procedures vary from bank to bank, but here’s what you need to do in most cases:

Step 1. Check your bank’s website

Find out if your bank allows you to make international payments online; if not, you may have to visit the bank in person. You can find out by checking their website or calling your bank.

Step 2. Log in to your bank account

If you are allowed to use the online banking application or website, log into your bank account and navigate to the telegraphic transfer section. This may be marked as telegraphic transfer, wire transfer, or similar terminology.

Step 3. Check fees and exchange rates

Since telegraphic transfers need to be sent through the corresponding banks, which are sometimes different from yours, check the fees before sending the money.

You should also check what exchange rate your bank uses to convert your money and compare it to the middle market rate to see if you’re getting a good deal.

Step 4. Provide the necessary information

Provide the name of your recipient and their address if necessary. You will also need their basic banking information, such as SWIFT/BIC code.

Telegraphic Transfer FAQ

1. What is the difference between telegraphic transfer and bank transfer?

There is no difference between telegraphic transfer and bank transfer. When you make an international money transfer through a bank, it is sent by telegraphic transfer. Therefore, telegraphic transfer is a component of bank transfer.

2. What is the difference between telegraphic transfer and wire transfer?

Telegraphic transfer and wire transfer are both examples of EFT. There is no real difference except for their names.

Telegraphic transfer refers more to using a traditional telex to send money, while wire transfer refers more to the electronic transfer of funds.

3. How long does a telegraphic transfer take?

Generally speaking, telegraphic transfers take 2-4 days to complete. However, it may take longer depending on the country the funds are being sent to, the currency involved, and the amount of money sent.

4. What beneficiary information do I need before sending a telegraphic transfer?

You will need to provide the beneficiary’s details as follows:

- Beneficiary name

- Beneficiary address

- Beneficiary account number

- Bank

- Bank address

- SWIFT code

- Beneficiary’s country

- Remittance purpose

Telegraphic Transfer Conclusion

Due to telegraphic transfers or TT, transferring funds to another account overseas has become much easier. You can save money and end up paying less in the long run.

However, be careful of possible scams when making telegraphic transfer transactions. You can leave a comment below if you want to learn more about international payment methods.

We are Yansourcing, a leading sourcing agent in China. If you are looking for international trade but do not have any experience importing or customizing products from China, please do not hesitate to contact us!