Turning a polished design into an executable China sourcing package is where many programs stumble.

Quotes come back all over the place, samples miss critical details, and POs balloon with surprise costs.

The fix is a disciplined, step-by-step conversion from EBOM and drawings into a supplier-ready MBOM, a standardized RFQ that forces apples-to-apples responses, enforceable PO terms, and measurable QC.

Let’s dig in.

Step 1 — Scrub your EBOM into a supplier-ready MBOM

Engineering intent (EBOM) is not the same as manufacturing reality (MBOM). Your goal is a supplier-ready MBOM that eliminates ambiguity and anchors every downstream decision. Govern it with clear revision control and a single source of truth.

Minimum fields to include (with examples):

- Identification: top-level product number; component part numbers and descriptions; revision and effectivity dates.

- Quantity and units: qty per parent, unit of measure (EA/SET/KG), scrap factor if relevant.

- Material and grade: 304L stainless steel; ABS+PC FR, UL94 V-0.

- Critical dimensions and tolerances: show GD&T callouts; pick one system and state it on the title block (ASME Y14.5 or ISO 1101/GPS). See differences covered by GD&T Basics in their comparison of ISO vs ASME standards.

- Surface finish and process: anodize Type II matte; powder coat matte, 60–70 GU.

- Color standard and tolerance: Pantone 285U, ΔE00 ≤ 1.5 (D65, 10°, d/8).

- Packaging unit and labeling: 10/inner, 50/master; barcode format; carton marks.

- Procurement and sourcing context: make/buy indicator; preferred vendor list; supplier part number; lead time.

- Documentation control: drawing/model file references; lifecycle state (released/obsolete).

Template snippet (copy into your spreadsheet or PLM notes):

Part No | Rev | Description | Qty/Parent | UoM | Material & Grade | Critical Dims/Tols | Finish | Color & ΔE | Pack (inner/master) | Supplier PN | Lead Time | Doc Ref

C-1102 | B | Housing, ABS+PC FR | 1 | EA | ABS+PC, UL94 V-0 | Ø60 ±0.1; Position 0.2 | Powder coat matte | Pantone 285U, ΔE00 ≤1.5 | 10/50 | SUP-9821 | 21 days | DRW-1102-B

Acceptance checklist:

- MBOM includes material grade, tolerances, finish, color standard and ΔE, and packaging unit.

- One GD&T system is named on drawings; datum scheme and critical features are clear.

- Each item has UoM, qty per parent, and a stable part number plus revision.

- Document links and effectivity dates are present; change control is defined.

Step 2 — Assemble an RFQ for your China sourcing package

Your RFQ must force comparable responses. Require every supplier to fill the same sheet, anchored by the MBOM and drawings.

Required RFQ fields:

- Project info: RFQ number; buyer contact; product name and function; target milestones; factory location.

- Specifications: attach MBOM and drawings; list materials/grades, critical dims/tolerances, finishes; color standard and ΔE; packaging specs with inner/master and labels.

- Quantity tiers and MOQs: e.g., 500/1,000/5,000; pilot vs mass production quantities.

- Pricing and one-time charges: unit price by Incoterm; tooling/mold/NRE; setup fees; packaging cost per unit.

- Lead times: tooling, T1 sample, mass production.

- Shipping and logistics: Incoterms 2020 term and named place/port; shipping method; palletization. Responsibilities change by term; the ICC explains Incoterms 2020 rules.

- Payment and commercial terms: deposit/balance or LC; currency; quote validity.

- Quality and inspection: FAI, DUPRO, PSI; AQL levels and inspection level per ISO 2859-1; lab testing if required. A practical overview is QIMA’s AQL explainer.

- Supplier qualifications: certifications (ISO 9001/IATF 16949/ISO 13485), capacity, similar-product experience.

- Exceptions and cost-downs: deviations, assumptions, optional alternatives.

RFQ template snippet:

RFQ No: RFQ-2026-017 Buyer: A. Lee Supplier: Guangdong XYZ Factory

Product & Function: LED desk lamp, adjustable arm

Specs: See MBOM + DRW set; Material 6063-T5; Anodize II matte; Color RAL 9005, ΔE00 ≤1.5

Quantities: 500 / 1,000 / 5,000 units

Prices (FOB Shenzhen): 500: $6.80 | 1,000: $6.40 | 5,000: $5.95

Tooling/NRE: $3,200 (buyer ownership); Packaging: $0.35/unit

Lead Times: Tooling 28 days; Sample 10 days after tooling; MP 20 days after sample approval

Incoterm: FOB Shenzhen Yantian; Payment: 30% deposit, 70% before shipment; Validity: 60 days

Quality: FAI required; DUPRO at 50%; PSI at 100% packed; AQL: Critical 0.0, Major 2.5, Minor 4.0 (General II)

Certifications: ISO 9001; Experience: 3 similar lamp projects

Exceptions/Alternatives: None

Acceptance checklist:

- RFQ includes MBOM and drawings, quantity tiers, Incoterm with named place, and AQL criteria.

- Tooling/NRE and packaging costs appear as separate line items with ownership noted.

- quote validity and payment terms are explicit.

- A mandatory “exceptions/assumptions” field is present.

Step 3 — Run an apples-to-apples RFQ comparability matrix

Normalize supplier responses so you can compare costs, lead times, and risks on the same baseline. Keep pricing per unit under the same Incoterm and pack unit; allocate tooling over expected volumes when needed. Record exceptions and quantify their impact.

Comparability matrix (example for the 1,000-unit tier, FOB Shenzhen):

| Supplier | Unit Price | Tooling/NRE | Packaging $/unit | Lead Time (Tooling / Sample / MP) | Payment Terms | Certifications | Exceptions |

|---|---|---|---|---|---|---|---|

| A (Guangdong XYZ) | $6.40 | $3,200 | $0.35 | 28d / 10d / 20d | 30/70 | ISO 9001 | None |

| B (Zhejiang ABC) | $6.25 | $4,000 | $0.28 | 30d / 12d / 18d | 20/80 | ISO 9001, IATF 16949 | Color ΔE00 ≤2.0 |

| C (Jiangsu LMN) | $6.55 | $2,900 | $0.40 | 26d / 9d / 22d | 40/60 | ISO 9001 | Pack change to 8/40 |

Acceptance checklist:

- All quotes shown under the same Incoterm and pack unit.

- Tooling/NRE separated from unit price, with an amortization plan if needed.

- Lead times listed for tooling, sample, and mass production.

- Exceptions are captured and assessed.

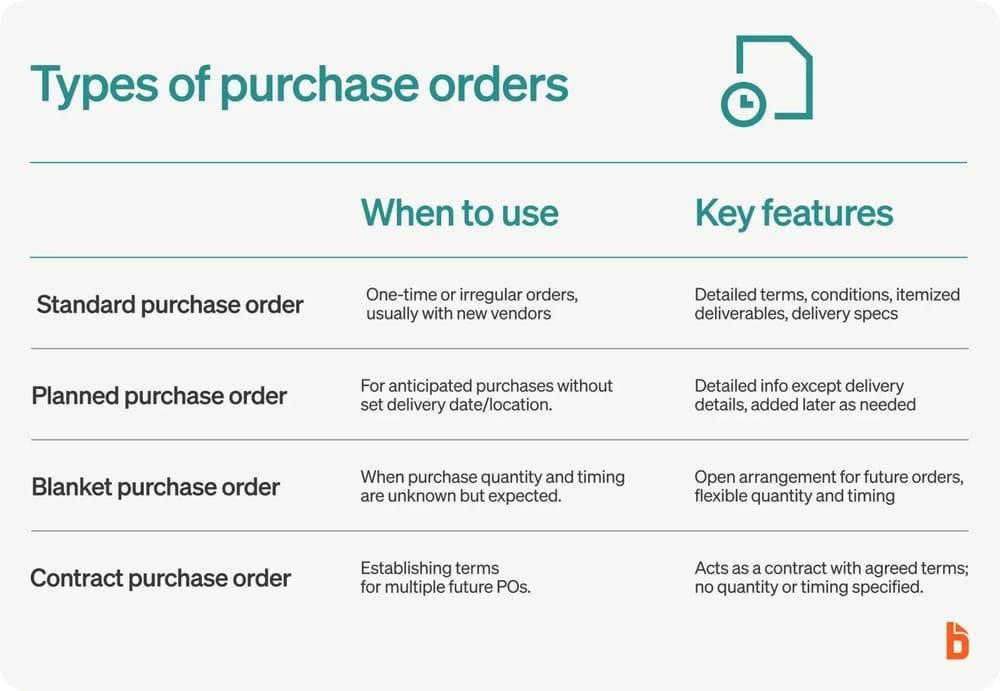

Step 4 — Lock China-ready PO terms and attachments

A PO isn’t just price and quantity; it’s where you bind responsibilities. Clarify logistics, payment schedules, ownership, change control, and inspection criteria.

Practical PO inclusions:

- Incoterm and named place with terminal handling clarification for FOB. To prevent disputes, explicitly state origin terminal handling allocation, aligning with recognized guidance from carriers and forwarders; the ICC’s materials on risk transfer in Incoterms 2020 cover the foundational responsibilities.

- Payment schedule: deposit and balance triggers or LC; currency; bank details.

- Tooling ownership and maintenance: buyer owns molds/dies/fixtures; no use for other customers; access and return rights; maintenance responsibilities. Non-legal guidance on enforceable PRC contracting and NNNs is outlined by Harris Bricken in China NNN agreements.

- Anti-subcontracting and traceability: no subcontracting without written consent; flow down obligations; primary supplier liable for subcontractor actions.

- ECO/ECN change control: written approval required; effectivity dates; price impact method.

- Acceptance criteria and inspection plan: attach FAI/DUPRO/PSI protocol with AQL levels.

- Remedies: penalties for delay or nonconforming goods; re-inspection costs; corrective action expectations.

PO checklist snippet:

PO No: PO-2026-044 Effective: 2026-02-10 Buyer: BrightCo Supplier: Guangdong XYZ

Incoterm: FOB Shenzhen Yantian (seller bears origin THC to on-board)

Price: $6.40/EA (1,000 units) + Packaging $0.35/EA; Tooling $3,200 (Buyer ownership)

Payment: 30% deposit at PO; 70% before shipment after PSI pass

Tooling: Buyer-owned; no third-party use; maintenance per Annex B; return on demand

Subcontracting: Prohibited without Buyer consent; obligations flow down; Supplier liable

Changes: ECO/ECN by Buyer only; written approval required; effectivity and price adjustment documented

Quality: FAI, DUPRO, PSI per Annex A; AQL Critical 0.0, Major 2.5, Minor 4.0 (General II)

Remedies: Late delivery penalty 1%/week capped at 10%; rework at Supplier cost; re-inspection at Supplier cost

Governing Law & NNN: See Manufacturing Agreement (Chinese version controls); consult PRC counsel

Acceptance checklist:

- Incoterm and named place stated; payment schedule and price validity defined.

- Tooling ownership, anti-subcontracting, and change control clauses included.

- Inspection plan with AQLs attached; remedies and re-inspection cost allocation specified.

- Chinese-language manufacturing agreement referenced; legal review planned with PRC-qualified counsel.

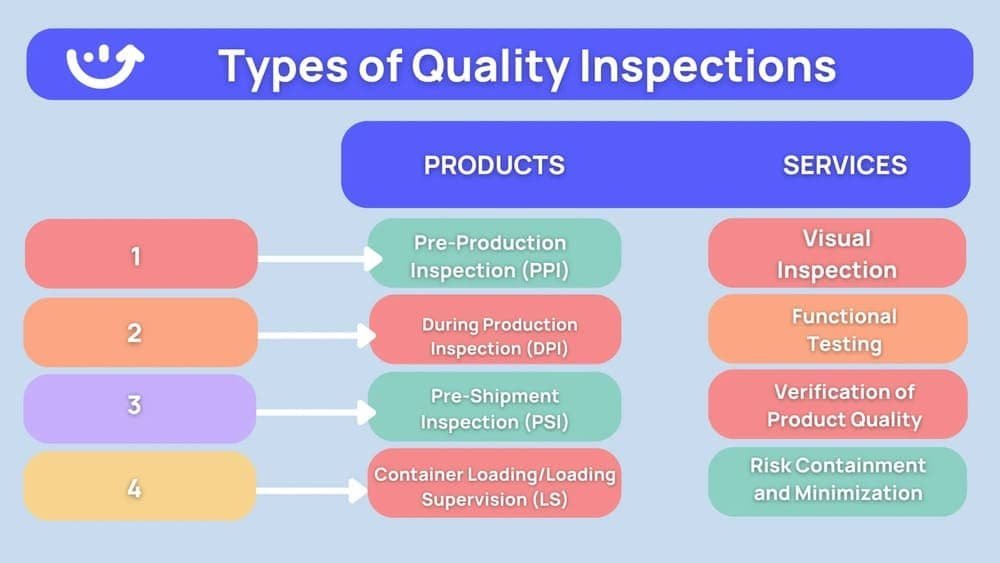

Step 5 — Define QC and inspection criteria — FAI → DUPRO → PSI

Quality must be measurable. Specify inspection stages and sampling rules, and precisely define color/finish and packaging validation.

Inspection plan highlights:

- Stages: FAI at first production pieces; DUPRO around 50% completion; PSI when ≥80% finished and packed.

- Sampling: ISO 2859-1 attributes sampling at General Inspection Level II; defect classes and AQLs (Critical 0.0, Major 2.5, Minor 4.0) aligned to risk. QIMA’s overview of AQL is a practical reference.

- Color and finish: use CIE Lab* ΔE00 with illuminant/observer and geometry defined; e.g., ΔE00 ≤ 1.5 under D65, 10°, d/8.

- Packaging validation: declare the intended ISTA procedure (1A/2A/3A) and carton specs. See the ISTA test procedure overview.

PSI report snippet:

Lot Size: 1,000 Sample Size: 80 (ISO 2859-1, General II)

AQL: Critical 0.0 | Major 2.5 | Minor 4.0

Defects Found: Critical 0 | Major 1 | Minor 3 Result: PASS (Ac/Re per plan)

Dimensions: 10 critical features measured; all within tolerance

Function Tests: Switch cycles 100x; all pass

Color: ΔE00 results max 1.2 (D65, 10°, d/8) vs target ≤1.5; finish gloss 65–70 GU

Packaging: 10/inner, 50/master; carton marks correct; compression test per ISTA 3A plan

Photos: Attached; Corrective Actions: Not required

Acceptance checklist:

- Inspection stages, sampling standard, inspection level, and AQLs stated.

- Defect classes have examples; dimensional/functional/color/packaging tests listed.

- PSI report fields cover Ac/Re, measurements, defects, and photos.

- Who pays for re-inspection and corrective actions is clear in the PO.

Short sector callouts to add to your RFQ/PO

- Consumer electronics: reference RoHS and REACH obligations; EU CE marking context; US UL/NRTL certifications as applicable. Ask suppliers for relevant files and lab test history.

- Medical devices: require ISO 13485 QMS and declare intended regulatory pathway early. Align risk controls with EN ISO 14971 and relevant biocompatibility or electrical standards.

- Automotive: require IATF 16949 and state APQP/PPAP deliverables and customer-specific requirements where applicable.

Practical example — Coordinating inspections across suppliers

Disclosure: Yansourcing is our product.

Coordinating PSI across three factories can be messy—different sampling picks, checklist gaps, and timing conflicts.

Using a China sourcing agent like Yansourcing as a neutral coordinator, you can standardize the ISO 2859-1 sampling plan, share one consolidated PSI checklist tied to your drawings, and align booking windows so results land before your vessel cut-off.

This reduces re-inspection churn and keeps your PO acceptance tied to the same criteria across suppliers.

Two quick before/after mini-cases

- Case A — Plastic housing color mismatch Before: RFQs lacked ΔE tolerance and illuminant settings; samples looked fine in office light but failed in daylight. After: RFQ added Pantone and ΔE00 ≤ 1.5 under D65, 10°, d/8; PO bound the PSI color check. Result: T1 samples passed; no color dispute at shipment.

- Case B — Simple assembly with new tooling Before: Quotes hid tooling ownership and packaging costs; PO stage added $4,500 mold fee and $0.40/unit pack. After: RFQ listed tooling/NRE and buyer ownership, packaging cost per unit, and FOB named place. The comparability matrix exposed true total cost. Result: Supplier selection favored lower unit price with higher tooling but better lead time; PO locked ownership and inspection.

Downloadable-style template bundle (field lists)

- BOM essentials: part number; revision; qty/UoM; material grade; critical dims/tols; finish; color and ΔE; pack unit and labels; doc reference. → Templates download

- RFQ essentials: MBOM + drawings; quantity tiers; tooling/NRE + ownership; Incoterm + named place; lead times; packaging cost per unit; AQL; exceptions. → Templates download

- PO essentials: Incoterm and THC; payment schedule; price validity; tooling ownership; anti-subcontracting; ECO/ECN; acceptance criteria; remedies. → Templates download

- QC essentials: stages (FAI/DUPRO/PSI); ISO 2859-1 level and AQLs; defect classes; color ΔE settings; packaging validation (ISTA). → Templates download

Your next steps:

- Convert your EBOM into a supplier-ready MBOM with the minimum fields above.

- Issue a standardized RFQ and require all suppliers to complete the same sheet.

- Compare using the matrix, then bind responsibilities in a China-ready PO with QC attachments.

- If you need hands-on orchestration for RFQs and inspections, consider partnering with a China sourcing agent to coordinate suppliers under one consistent plan.