Want to import goods from China to Australia?

For many Australian sellers, especially those who are small to medium-sized business owners, the cost of manufacturing products domestically is too high compared to importing from China.

So, sourcing and importing products from China is a more practical and cost-effective way to do business online in Australia.

In this article, we’ve compiled a complete guide with everything you need to know, from important documents to taxes and more!

Why Should I Import from China to Australia?

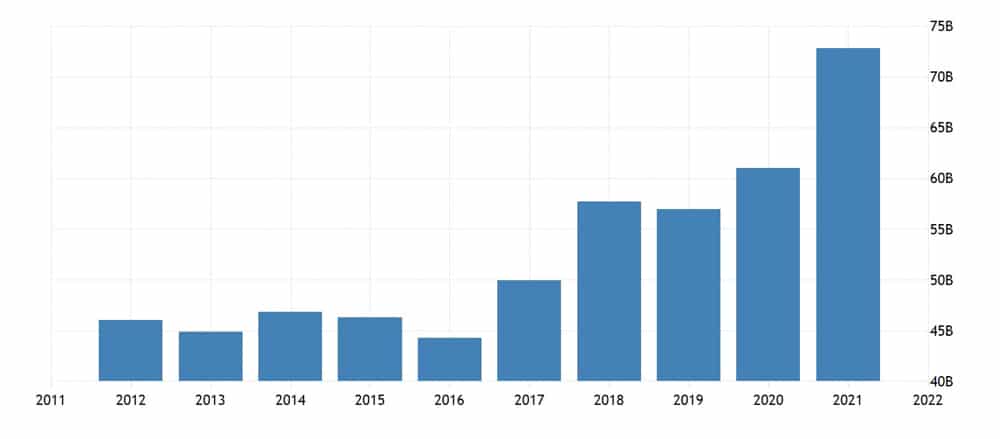

China is the undisputed leader in global manufacturing. Low labor costs, combined with a skilled workforce, enable China to produce quality products at low prices. It is no surprise that Australia imported US$72.86 billion worth of products from China in 2021.

China offers every Australian seller the opportunity to increase their profit margins. However, importing from China is not without risk. There may be hundreds of suppliers vying to produce your product.

It is up to the seller to find the right supplier for their business needs. While China’s competitive manufacturing market will lower your cost-per-product price, you will need to weed out the best from the rest.

How to Import from China to Australia?

We know that importing from another country can sound like a daunting task. That’s why we’re going to cover all the steps you need to know about importing from China to Australia.

Usually, you can take the following steps to import from China to Australia:

1. Product sourcing and verification

You may have an idea of the products you want to manufacture and/or import from China, but don’t know how to find the right suppliers or understand all the elements of buying from China Chinese suppliers.

Your best bet is to contact a sourcing company or do research on supplier websites such as Alibaba. Please keep the following in mind:

Australia’s requirements for importers: Australia has very strict biosecurity laws for certain products. You must keep track of product safety standards, labeling requirements, and laws regarding import permits.

Product development costs: China has the advantage of being a cheap labor and manufacturing country relative to other exporting countries.

However, Chinese suppliers are (in most cases) better at “copying” than making entire products from scratch.

Minimum order requirements: Almost all Chinese suppliers require a high minimum order quantity of several thousand units, as anything less than that is unprofitable.

If you are a small business or a start-up, this may not be feasible for you.

Product verification is always a necessary step before importing any goods into Australia. If you are a new business, make sure your product or business idea has real market value and marketability in Australia.

2. Discuss the terms of the deal with your supplier

The terms of your transaction may determine your potential liability for the goods. Read our Incoterms and why it is so important to establish this with your secure supplier from the outset.

Once your products and contracts are signed, it can be difficult to renegotiate these terms.

On the other hand, if your supplier is unable to provide logistical assistance, look for an export agent or freight forwarder to help you understand the customs clearance process for each incoterm.

3. Know the various regulations, duties, and licenses you need to export

Importing from China to Australia is relatively easy under the Free Trade Agreement established in 2015. With this free trade agreement, your products may be exempt from any duties (tariffs or taxes).

To determine if your product qualifies for a duty drawback, you will need to find out the HS Code for your product and do some research on the Department of Foreign Affairs and Trade website.

Alternatively, you can contact a freight forwarder or customs broker and consult with them to find out what type of rebate and exemption programs you qualify for.

You may learn more about Customs Clearance Process for details below:

A Complete Guide to The Customs Clearance Process

4. Arrange transportation for your shipment in advance

Depending on the nature of your shipment, there may be a number of options available for shipping your goods.

As a rule of thumb, if you are a junior importer, it is best to choose a reliable express such as DHL, TNT, etc. while you build up your market volume.

If you are an experienced importer, freight forwarders and 3PLs are a great way to increase your profitability and reduce freight costs by pooling the resources of 3PLs and taking advantage of their economies of scale.

You may learn more about China Fulfillment Centers for details below:

Ultimate Guide 2022: Top 10 China Fulfillment Centers

5. Distribute and market your products in Australia

To successfully import into Australia, your goods must be in the right place, in the right situation, to reach the consumer.

Finding retailers and stockists for your products to get your products into the hands of Australians is essential to your business plan.

Conduct research on your target market and where they hang out in order to effectively market your products.

What Documents Are Required for Importing from China to Australia?

Next, we will describe the documents required for importing from China to Australia.

1. Commercial Invoice

The commercial invoice lists the details of the export transaction and the terms of shipment.

The identity of the importer and exporter, the HS code and value of the goods, the quantity and weight of the goods, the terms of payment, and the total amount invoice denomination.

2. Packing List

The packing list serves as a checklist for the exporter, customs, and other interested parties to ensure that the goods have been properly packed.

It contains the following details:

- Description, quantity, weight, and dimensions of the goods

- Type of packaging used (e.g. boxes, cartons, vials, etc.)

- Details of the importer and exporter

- Commercial invoice number

- Any relevant marks or seal numbers used

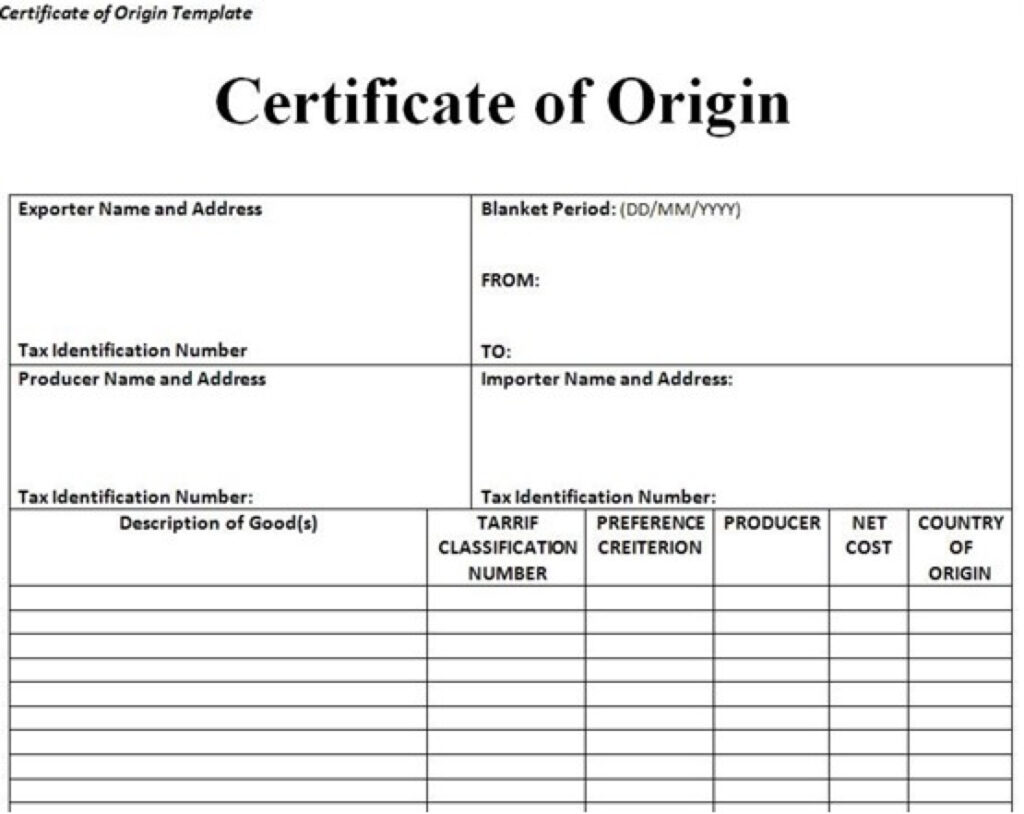

3. Certificate of Origin

In addition to the commercial invoice and packing list, a certificate of origin is required for customs clearance in Australia.

The main function of a Certificate of Origin is to show Customs where your goods were manufactured and shipped from.

Through the Certificate of Origin, Customs is able to determine if your goods are legal to import into Australia and can also determine if special conditions apply to your tax and duty obligations.

You may learn more about Certificates of Origin for details below:

Different Types of Certificates of Origin for Import and Export: The Complete Guide

3. SAC declarations/import declarations

Australian businesses importing goods from China are also required to complete an import declaration.

The import declaration serves to inform Customs of the imported goods, importer, mode of transport, tariff classification, and customs value.

There are two types of import declarations:

- Self-Assessment Clearance (SAC declaration) is applicable for import values below AUD 1,000

- N10 Import Declaration for values over AUD1,00

Australian importers only need to submit the one that applies to them.

4. Packing declaration (sea freight only)

The packing declaration contains information about the packing materials used in the shipment.

If the packaging materials contain wood, straw, or bark, they are at risk of harboring pests or fungi due to the long transit time by the sea.

To prevent this, the importer must fumigate the risky packaging materials and present the fumigation certificate to the authorities at the top of the packing declaration.

What Taxes Will be Paid for Importing from China to Australia?

Import taxes are common in Australia and other countries. Australian companies importing goods from China are subject to import duties on goods.

Some products covered by free trade agreements are subject to additional charges. However, certain import duties and charges only apply to specific goods imported into Australia.

The following duties and taxes are payable by companies importing from China to Australia:

- Processing fees: These tariffs apply to all goods for the Chinese market.

- Goods and Services Tax (GST): All goods are subject to a 10% GST.

- Excise Duty: This includes goods containing tobacco, alcohol, or fuel.

Australian companies can also claim tariff concessions. The average duty rate for most products imported from China to Australia is 0%.

These are taxes levied on the import and export of goods. In most cases, the value of the imported goods determines the duty rate.

The tax rates range from 0% to 10%, but most Chinese imports are subject to a 5% tax.

Here, we will do a quick calculation to determine the import duty using an assumed value of the goods:

You must note that the duty is 5% of the total value of the imported goods converted to Australian dollars. Therefore, this means that it is calculated using custom values.

- Import Duty = XX% x Customs Value

- Assuming the customs value of the goods is A$20,000, an import duty of 5% is payable.

- Import duty = 5% x 20,000 = A$1,000

What Shipping Methods Are Available for Importing from China to Australia?

There are 3 common shipping methods for importing your products from China to Australia:

1. Sea Freight (FCL)

FCL, or Full Container Load, is when your goods fill an entire container that is 20 feet or 40 feet long.

If you are shipping large quantities, you can save time and money by shipping FCL. Pricing for FCLs is flat regardless of whether your container is fully loaded or not.

2. Sea Freight (LCL)

LCL or less than a container load means that your shipment will not fill the entire container and will be shipped with other boxes or pallets.

Please note that when you ship LCL, your cargo needs to be consolidated at the port of origin and unconsolidated at the port of destination.

This is why LCL shipments take several days longer than full container shipments.

You may learn more about LCL vs. FCL for details below:

LCL vs. FCL: Which Shipping Method is better?

3. Air Freight or Express

Air freight or Express is often faster but more expensive than sea freight, so the mode you choose will depend on the size and weight of your shipment and how fast you need to get to your destination.

Comparatively speaking, sea freight is the cheapest mode and the one used by most importers, but has the longest delivery time, while express is the fastest but also the most expensive mode.

Air freight is somewhere between sea freight and express.

Depending on your actual needs and the volume and nature of your goods, choose the most cost-effective way to deliver your goods from China to Australia.

What Is the Shipping Cost for Importing from China to Australia?

The shipping cost determines the cost of transporting cargo from one point to another. The total cost is influenced by the type of cargo, mode of transportation, volume weight of cargo, and distance to the destination.

1. Air Freight costs and rates

For cargo weighing between 150 and 500 kg, standard air freight is the cheapest option.

For very light-sized shipments, charges may be based on volumetric weight rather than the actual weight, Choosing an express is by far the fastest, but it is a little more expensive.

2. Sea Freight costs and rates

Once a shipment weighs more than about 500 kg, sea freight becomes a cheaper option. Sea freight offers great economies of scale (some ships can carry 20,000 20-foot containers).

However, the prices have steadily increased since the summer of 2020, making sea freight less economical than it was before the pandemic.

Keep in mind that freight rates can vary widely between freight forwarders over time, so shop around before choosing your freight forwarder.

You can find a freight forwarder in Australia that you feel comfortable working with, or you can find a local freight forwarder in China whose services are often more affordable.

If you don’t like the idea of spending too much time and effort on finding a freight forwarder, you can also ask your supplier to do it for you, as long as you can make sure their quote is reasonable.

You may learn more about Alibaba Shipping Costs for details below:

Complete Guide: 10 Ways to Save Alibaba Shipping Costs

How Long Does it Take to Import from China to Australia?

The rule of thumb for delivery time (under normal conditions) is 1-2 weeks by post, 3 days by express, 8-10 days by air, and 30-40 days by sea.

1. By Post

Shipping from China by regular post takes a long time. China Post offers faster, more cost-effective options for airmail and Express Mail Service (EMS), both of which can take one to two weeks.

2. By Express

When shipping from China via international express, it can take at least three days to pick up the item at the doorstep of the Chinese supplier (unless the supplier has dropped it off at their warehouse). If it’s really urgent, there are more expensive premium services that can even deliver overnight.

3. By Air

Standard air freight between China and Australia usually takes about 8-10 days. It’s not that planes are slower; it comes down to the fact that the air freight process is more complex than express.

4. By Sea

Door-to-door shipping from China to Australia takes at least 30-40 days, with sea freight having the longest delivery time. That’s because ships move much more slowly than planes.

Most importantly, port congestion, customs delays, and adverse weather conditions affect sea freight more than air freight.

How Can I Find Suppliers for Importing from China to Australia?

Once you have identified the products you want to import from China, your next step is to find a suitable and reliable supplier for them.

There are two main ways to find Chinese suppliers, you can do this online in Australia or on-site in China.

The following are common ways to find Chinese suppliers online:

- Chinese Wholesale websites

- Search engines

- Social media platforms

Chinese wholesale websites provide an efficient and inexpensive way for online business owners to source products. Many wholesale marketplaces, such as Alibaba or DHgate, can be used to find suppliers.

Alibaba, for example, is the largest Chinese international trade platform and is used not only by Australian business owners but also by sellers around the world.

Therefore, you can source a large number of products and suppliers from it.

To find suppliers on Alibaba, you can simply search for keywords for your target products and find the best match, or you can submit a Request for Quotation (RFQ) and wait for the supplier to contact you.

In addition to wholesale websites, there are other online channels, including search engines such as Google and social media platforms such as LinkedIn, that you can use to find your ideal supplier.

You may learn more about China Wholesale Websites for details below:

Complete List 2022: Top 30 Best China Wholesale Websites

The following are common ways to find Chinese suppliers offline:

- China trade fairs

- Chinese wholesale markets

- Chinese industry clusters

A significant number of sellers prefer to source their products in a more direct way – by visiting China so they can see the products in person and get the most competitive prices.

China trade fairs and Chinese wholesale markets are where most Australian sellers source their products.

China hosts thousands of trade fairs every year and if you want to make sure the one you attend is the best choice for you, you can check out this list of the top-rated China trade fairs.

Wholesale markets are much like trade fairs, but with less restrictive product categories and lower minimum order quantities (MOQs).

If you can’t attend any trade fairs, then maybe you can go to one of those famous wholesale markets in China and find what you are looking for.

Some experienced sellers choose to go deeper into industry clusters as opposed to trade fairs and wholesale markets.

It is a known fact that the more original your supply sources are, the more likely you are to get lower prices.

You may learn more about China Wholesale Markets for details below:

China Wholesale Markets | The Best Guide for Beginners

Import from China to Australia FAQ

1. Is there any import duty on imports from China to Australia?

Import duty applies to every product exported from any country/region.

If you are importing goods from China to Australia, you will need to pay some tax on most products, which is a reasonable percentage of 5%. It also varies from product to product.

2. Who will declare the goods if imported from China to Australia?

Australian Customs law requires that only the importer of the product can date the import declaration.

And this import declaration is necessary to complete the verification process, as is the documentation at the point of clearance.

3. What products are regulated in Australia?

Some products are regulated because they pose a safety threat to Australia.

Australian Customs has placed greater emphasis on the inspection of products such as children’s toys, groceries, furniture, bicycles, health products, and cosmetics.

It is your responsibility to look for Australian standards before importing products.

4. What products does Australia mainly import from China?

You can import furniture and building materials; such as wall coverings, ceilings, etc., tiles, kitchen tools, cabinets, windows, steel, glass, clothing, electronics, toys, and machinery.

All these products are on the popular list for import from China to Australia.

Import from China to Australia Conclusion

Importing from China to Australia can be challenging, but if you’re careful, it’s the best way to increase your profits. Lower product costs will also allow you to compete more effectively locally in Australia.

If you have anything to say or any questions after reading this, please leave a comment below.

We are Yansourcing, a leading sourcing company in China, dedicated to helping our clients source products from China at the most competitive prices. If you are interested in importing from China, please feel free to contact us.