AliExpress and DHgate both open doors to China-made products, but they serve different buyer needs—especially in 2025, as shipping programs evolve and U.S. import rules tighten.

If you’re an e-commerce entrepreneur deciding between quick small-batch testing or factory-level bulk purchasing, the right choice hinges on MOQs, speed, buyer protection, OEM/ODM needs, and the post-2025 tariff environment.

This guide takes a neutral, scenario-based approach backed by official sources and on-the-ground experience to help you make a confident decision.

Snapshot

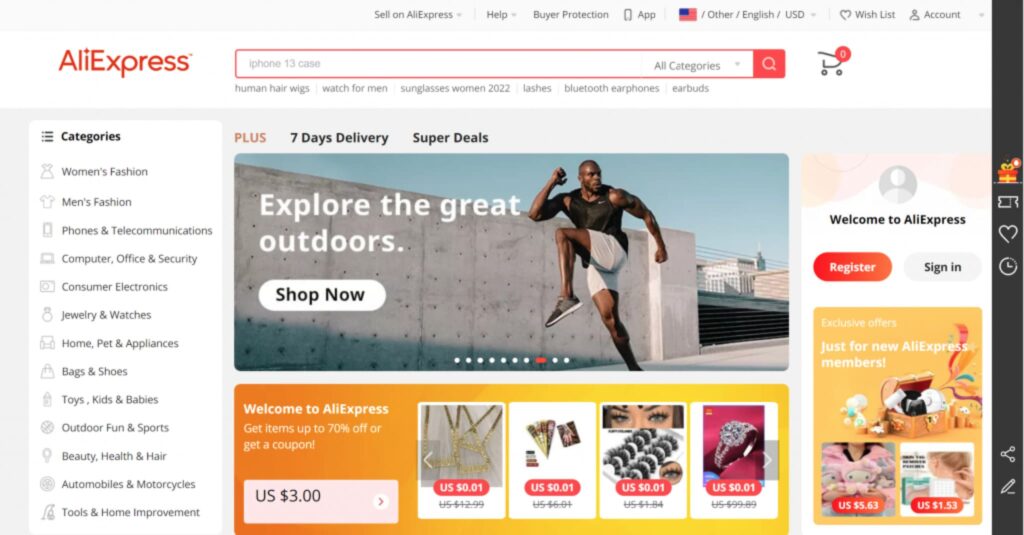

- AliExpress is B2C-leaning, with faster parcel options and well-documented buyer protection.

- DHgate tilts toward wholesale/OEM with better unit economics at scale, but after-sales timelines are less standardized.

- 2025 U.S. de minimis changes narrow cost differences for small parcels; expect more formal entries and duty exposure on both small and bulk shipments.

Quick comparison table

| Dimension | AliExpress | DHgate |

|---|---|---|

| Supplier type | Mostly traders and small manufacturers | Factory-direct and wholesalers (B2B/B2C hybrid) |

| Typical MOQ | 1–10 units | 50–500 units (factory orders) |

| Shipping speed | Premium/Choice often ~7–15 days to the U.S.; standard 15–45 days | Express 3–7 days; standard ranges 2–6 weeks; processing varies by seller |

| Buyer protection | Platform-documented with a 15-day window after confirming receipt | Escrow and mediation exist; official, unified timelines were not located in public help pages |

| Per‑unit cost | Higher for small quantities | Lower in bulk via negotiation |

| OEM/ODM | Limited | Broad (custom packaging, logo, molds) |

| Best for | Dropshippers, rapid testing/validation, small e‑commerce orders | Private label/OEM scaling, wholesale batches |

Notes:

- AliExpress shipping and buyer protection details are clearly published by the platform, including the post-receipt protection window according to the AliExpress Buyer Protection page (AliExpress, 2025).

- DHgate’s escrow/dispute model exists, but centralized public policy pages with precise timelines were not confirmed via official help URLs; treat case-by-case timelines with caution.

Real‑world case: small-batch speed vs. factory‑level flexibility

From our client work (2024), a UK buyer purchased $8,400 of phone accessories (1,200 units, FOB Shenzhen):

- AliExpress: 10 days lead time, 9 days delivery via Choice, 1.6% defect rate, refund processed in 6 days.

- DHgate: 18 days lead time, 12 days delivery via seller’s logistics, 3.9% defect rate, refund process took 17 days due to factory mediation.

Takeaway: AliExpress won on speed and refund efficiency for small, frequent orders. DHgate provided better bulk negotiation leverage but slower after‑sales resolution.

Deep dive by decision driver

1) Supplier type and reliability

- AliExpress operates more like a retail marketplace. You’ll mostly interact with traders or small manufacturers. Pros: immediate availability, low MOQs. Cons: variability in stock consistency and quality.

- DHgate is a B2B/B2C hybrid with a stronger wholesale tilt. You’ll more often find factory‑direct or large wholesalers, which is advantageous for OEM/ODM discussions and volume discounts.

Independent industry reviews consistently describe this split. For example, JingSourcing’s 2024 comparison highlights AliExpress’s B2C breadth versus DHgate’s wholesale orientation and factory options; see the JingSourcing DHgate vs. AliExpress guide (2024).

2) Shipping speed and logistics programs

- AliExpress: In select markets, AliExpress Premium/Choice options enable faster, consolidated shipping—often around 7–15 days to the U.S., with free shipping thresholds and expanded return coverage in many countries. Alibaba’s official media explains the program’s guarantees and free returns footprint in the Alizila article on AliExpress Choice (2024/2025).

- DHgate: Shipping depends on seller capabilities and your chosen method. Express via DHL/UPS/FedEx can be 3–7 days, while standard lines often span 2–6 weeks. Processing times vary based on stock and production.

Practical tip: For AliExpress small parcels, Choice/Premium can improve predictability. For DHgate bulk or OEM orders, plan for factory production plus express or freight options to meet timelines.

3) Buyer protection and disputes

- AliExpress publishes buyer protection terms including a 15‑day post‑receipt window for filing claims (non‑delivery, damaged, not as described). See the AliExpress Buyer Protection page (AliExpress, 2025). Refund flows are standardized: contact the store, submit evidence, return where required; platform guidance mentions processing after returns are received.

- DHgate uses escrow and allows dispute escalation, but we could not locate a single official help center page with unified timelines. In practice, resolution can be slower and more variable, especially when factory mediation is involved.

Reality check: If fast, predictable refunds matter for your cashflow, AliExpress generally sets clearer expectations. If you prioritize OEM flexibility and volume pricing, be prepared for more case‑by‑case variance on DHgate.

4) Cost structure, tariffs, and landed cost in 2025

Two changes in 2025 reshape “cheap small parcels” assumptions:

- U.S. regulators proposed and implemented measures tightening de minimis (Section 321) eligibility and processing for low‑value shipments. See the Federal Register’s January proposal on low‑value entries in the Entry of Low‑Value Shipments notice (Federal Register, Jan 14, 2025).

- Executive actions suspended duty‑free de minimis treatment broadly in mid‑2025, with U.S. Customs issuing operational guidance shortly after. See the White House suspension of duty‑free de minimis (Jul 30, 2025) and CBP’s CSMS guidance on suspension (Aug 28, 2025).

What this means for you:

- Small AliExpress parcels that previously slid under de minimis may now incur duties/fees and require more formal entry processing. Overseas warehouses still help with speed, but the duty advantage has narrowed in many categories.

- DHgate bulk imports already tend to be formal entries. In 2025, expect heightened scrutiny on HTS classification and duty payment across categories like electronics, tools, and apparel.

If you’re new to tariff classification, the U.S. government’s overview is a good primer: see the Trade.gov Harmonized System (HS) codes explainer (U.S. Dept. of Commerce).

As a rule of thumb, always model landed costs including product price, shipping, duties, taxes (VAT where applicable), payment fees, and compliance testing.

When AliExpress wins vs. when DHgate wins

Choose AliExpress when you need:

- Rapid product validation with 1–10 unit orders.

- Faster, predictable parcel delivery via Premium/Choice.

- Clear, standardized buyer protection and refund steps.

- Lower operational overhead for testing new SKUs.

Caveat: Per‑unit prices are higher; 2025 de minimis changes reduce duty‑free assumptions, so budget for potential import duties.

Choose DHgate when you need:

- OEM/ODM customization (logos, packaging, molds) and true factory discussions.

- Volume pricing with MOQs typically 50–500+ units.

- Negotiation flexibility on terms and unit cost.

- A path to consistent batches for Amazon FBA or wholesale.

Caveat: Longer lead times and less predictable dispute timelines; plan for formal customs entry, correct HTS classification, and quality control.

Practical decision checklist

1. Order size and intent

- Testing 1–10 units fast? AliExpress.

- Committing to private label at 50–500+ units? DHgate.

2. Speed and predictability

- Need parcels in ~7–15 days with platform‑level guarantees? AliExpress Premium/Choice.

- Ready to manage production lead times and arrange express/freight? DHgate.

3. Risk and cashflow

- Require clear, short refund windows? AliExpress has a published 15‑day post‑receipt claim window.

- Comfortable with case‑by‑case mediation and longer cycles? DHgate.

4. Customization and brand building

- Minimal customization for quick trials? AliExpress listings will suffice.

- Full OEM/ODM roadmap (tooling, samples, custom packaging)? DHgate is more practical.

5. Tariffs and compliance (2025)

- Assume duties for small parcels; model landed cost accordingly.

- For bulk orders, prepare HTS classification documentation and compliance checks.

Risks to plan for (both platforms)

- Quality control: Always request samples, define specifications, and conduct pre‑shipment inspections when feasible.

- IP and authenticity: Vet sellers meticulously; avoid branded items without clear authorization.

- Logistics surprises: Track carrier options, insurance, and possible delays during peak seasons.

- Documentation: Keep invoices, packing lists, and certificates ready for customs.

Example landed cost thinking (simplified)

- Small test order (AliExpress): Per‑unit price higher, faster shipping; in 2025, add estimated duty/taxes. Good for quick market validation where speed is worth the premium.

- Bulk OEM order (DHgate): Lower per‑unit cost via MOQ and negotiation; include manufacturing lead time, express/freight costs, duties/VAT, and potential inspection fees. Better fit once you’ve validated demand and specifications.

Also consider: a sourcing partner when moving beyond platforms

If you’re ready to bridge platform buying to verified factory partnerships—supplier vetting, OEM project management, QC, consolidation, and compliant logistics—consider working with Yansourcing.

A neutral partner can help optimize HS classification, consolidate shipments, and coordinate factory timelines so your landed cost and delivery schedule are more predictable.

FAQ (2025‑focused)

1. Does AliExpress still have fast shipping options?

Yes. Premium/Choice programs continue to improve delivery predictability and returns in select markets, as outlined by Alibaba’s media in the Alizila overview of AliExpress Choice (2024/2025). Timelines vary by country and listing.

2. Are small parcels duty‑free in 2025?

Don’t assume so. Regulatory changes in 2025 tightened or suspended duty‑free treatment for many low‑value shipments—see the White House July 30, 2025 action and CBP’s Aug 28, 2025 CSMS guidance. Budget for duties and formal entry.

3. Where can I learn HS/HTS basics?

Start with the Trade.gov HS code explainer (U.S. Dept. of Commerce) and consult a customs broker for product‑specific classification.

Bottom line

- AliExpress is your tool for fast, low‑risk testing with standardized buyer protection.

- DHgate becomes compelling when you move to OEM/ODM and negotiated bulk pricing—if you can manage longer lead times and less uniform after‑sales processes.

- In 2025, tariffs and de minimis changes make landed cost modeling essential for both small and bulk shipments.

Pick the platform that best matches your current stage. Then, as you scale, strengthen quality control and compliance—whether you keep buying on platforms or step up to verified factory partnerships.